Search News

Click chart to track futures.

Click chart to track futures.

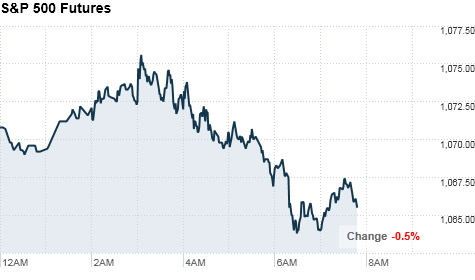

NEW YORK (CNNMoney.com) -- U.S. stocks were set for a lower start Friday as investors continued to fret about the economy.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly lower. Futures, which measure current index values against perceived future performance, were higher earlier in the morning.

U.S. stocks tumbled Thursday after weak economic reports - particularly, a rise in weekly jobless claims to 500,000 - slammed confidence. The Dow lost 1.4%, while the S&P 500 and Nasdaq both shed 1.7%.

"Investors remain on edge over the direction of the economy," said Peter Cardillo, chief market economist at Avalon Partners. "Recent economic reports, especially employment data, continue to be a worry for the market and overhadow the good news, including the expansion of corporate America."

While takeover activity and merger deals are picking up steam, a sign that companies are preparing for "better times," Cardillo said the market is still debating whether the economy is headed for a double-dip recession.

Economy: Investors will be watching for a reading on state unemployment. It will come a day after a report showed the number of Americans filing for unemployment insurance unexpectedly surged last week.

Companies: Hewlett-Packard (HPQ, Fortune 500) posted solid quarterly profit and sales figures after U.S. markets closed Thursday. The company's stock was down 1.1% in premarket trading.

Dell (DELL, Fortune 500) also reported higher earnings, posting results that topped Wall Street's estimates. Shares of the nation's No. 2 personal computer maker slipped 2.8% in premarket trading.

World markets: European shares retreated in morning trading. Germany's DAX and the CAC 40 in France were down more than 1%. Britain's FTSE 100 was 0.6% lower.

Asian markets ended the session in negative territory. Japan's Nikkei led declines in the region, sinking nearly 2%. The Shanghai Composite dropped 1.7% and the Hang Seng in Hong Kong fell 0.4%.

Currencies and commodities: The dollar rose against the euro, the U.K. pound and the Japanese yen.

Oil futures for September delivery fell 75 cents to $73.68 a barrel. Gold for December delivery slipped $3.30 to $1,232.10.

Bonds: Prices for Treasurys were higher. The yield on the 10-year note fell to 2.56% from 2.57% late Thursday. Bond prices and yields move in opposite direction ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |