Search News

Click chart for more markets data

Click chart for more markets data

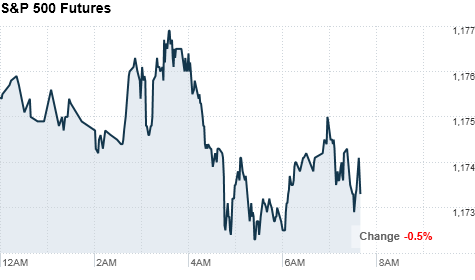

NEW YORK (CNNMoney.com) -- U.S. stock futures were poised to fall at the open Friday as investors digest the first reading on economic growth in the third quarter, and remain cautious ahead of next week's Federal Reserve meeting.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures we all lower ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks ended flat Thursday after a strong start gave way to trepidation ahead of the Fed's meeting, and the highly-anticipated Nov. 3 vote to determine control of Congress.

Investors have had a more tepid response to earnings this quarter, he added. "This quarter has been as good as the last three, and it hasn't moved the needle," said Art Hogan, chief market strategist at Jefferies & Co.

Economy: Investors will take in a host of economic reports Friday.

Ahead of the opening bell, the government issued its first look at third-quarter gross domestic product -- the broadest measure of the nation's economic activity.

The government reported that GDP rose at an annual growth rate of 2% in the third-quarter, slightly higher than prior three months, and in line with the consensus estimate from Briefing.com.

GDP grew at a rate of 1.7% in the second quarter.

Also before the bell, the Bureau of Labor Statistics reported compensation costs for civilian workers increased 0.4% in the third quarter.

After the opening bell, reports on manufacturing activity in the Chicago area and a revised reading on consumer sentiment in October will be released.

Companies: Merck (MRK, Fortune 500) and Sony (SNE) were among the big companies reporting results ahead of the opening bell.

Merck topped analyst forecasts by 3 cents a share, reporting a profit of 85 cents a share. Merck's third quarter net income was $342 million, spurred by progress in emerging markets.

Shares of Merck were up about 2% in premarket trading.

Sony reported a third-quarter net income of $375 million, driven by higher sales and cost cutting. The electronics maker also raised its income forecast for the rest of the year, despite the expectation of a continued difficult business environment.

Shares of Sony edged higher in premarket trading.

Meanwhile, shares of Microsoft (MSFT, Fortune 500) rose more than 3% in premarket trading, after the software giant said late Thursday that sales and profits in the most recent quarter rose more than analysts expected.

Also, Coinstar (CSTR)'s stock soared nearly 17% in premarket trading after it reported earnings that blew past analyst forecasts and raised its full-year guidance. The company's Redbox DVD vending business has been a big boost, and Coinstar recently recently said it planned on expanding into streaming, putting the heat on Netflix (NFLX).

World markets: European shares fell in early trading. The CAC 40 in France was down 0.7%, Germany's DAX dropped 0.3%, and Britain's FTSE 100 slid 0.5%.

Asian markets ended their session lower for the day. Japan's benchmark Nikkei fell 1.8%, while the Hang Seng in Hong Kong and Shanghai Composite dipped 0.5%.

Currencies and commodities: The dollar strengthened against the euro and British pound, but fell against the Japanese yen.

Oil futures for December delivery were off by 74 cents to $81.45 a barrel.

Gold for December delivery dropped $5.30 to $1,337.20 an ounce.

Bonds: Prices on U.S. Treasuries rose Friday, pushing the yield on the benchmark 10-year note down to 2.6%, from 2.7% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |