Search News

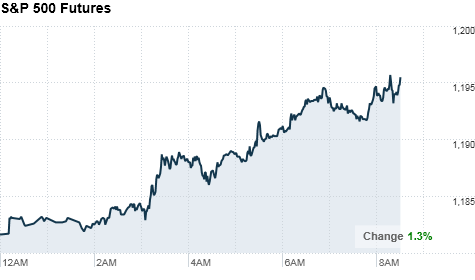

Click chart for more premarket data

Click chart for more premarket data

NEW YORK (CNNMoney.com) -- U.S. stocks headed for early gains Wednesday, following unexpectedly strong data on private payrolls.

Wall Street was also riding a rally in both Asian and European markets that came on the heels of China's strong manufacturing data and encouraging words from the head of the European Central Bank.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all up more than 1% ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks fell Tuesday, as weak housing data and worries about the debt crisis in Europe overshadowed a better-than-expected report on consumer confidence.

Despite a strong start to November, all three major indexes ended the month lower -- with the Dow holding just above the 11,000 point level.

Investors are starting December with several economic reports on tap, including fresh readings on the U.S. job market, a key index of manufacturing activity and monthly sales figures from automakers.

The Federal Reserve is scheduled to release a trove of data on its dealings related to the financial crisis later Wednesday. The data include transactions with Bear Stearns and AIG (AIG, Fortune 500), as well as purchases of mortgage-backed securities and other assets.

Economy: Monthly data from payroll processing firm ADP showed an unexpectedly high gain of 93,000 private sector jobs in November.

It marked the biggest gain in three years and came in much higher than the 58,000-job gain that was expected by a consensus of economists from Briefing.com. ADP also upwardly revised its tally for October, to a gain of 82,000 jobs -- nearly double the previously reported gain of 43,000.

The ADP report overshadowed an earlier report on planned job cuts in November from outplacement firm Challenger, Gray & Christmas. That report showed that employers planned to reduce payrolls by 48,711 jobs last month, up 28% from October, but is still down 3.3% compared with November 2009.

After the opening bell, the Institute of Supply Management will release its manufacturing index for November. Economists expect the index to edge down slightly to 56.5, from 56.9 the month before, according to consensus estimates from Briefing.com.

A government report on November construction spending is also scheduled for release shortly after trading starts.

The Fed's Beige Book -- a snapshot of economic conditions across the nation -- is due Wednesday afternoon.

World markets: Asian markets all ended the session higher after a couple of reports showed strength in China's economy. The Shanghai Composite added 0.1%, the Hang Seng in Hong Kong gained 1% and Japan's Nikkei rose 0.5%.

Despite ongoing eurozone debt jitters, European stocks followed Asian market's rally. Britain's FTSE 100 rose 1.7%, the DAX in Germany added more than 2% and France's CAC 40 ticked up 1.3%.

European Central Bank Chairman Jean-Claude Trichet indicated that the central bank is prepared and willing to support struggling nations, as it recently did with Ireland.

"What you saw was a small rally in developed Europe with the central bank basically saying that it will step up and it will not shy away and that it has the resources to do so," said Tim Speiss, chairman of Personal Wealth Advisors Group at EisnerAmper.

Spain is the next weakest link the European Union.

Companies: Ford (F, Fortune 500), GM (GM) and Toyota (TM) are among the major automakers scheduled to release monthly sales figures throughout the day.

In the tech sector, Verizon (VZ, Fortune 500) will hold a news conference at noon detailing the company's 4G network launch.

Currencies and commodities: The dollar fell against the euro and the British pound, but gained against the Japanese yen.

Oil for January delivery jumped $1.25 to $85.36 a barrel.

Gold futures for December delivery rose $1.50 to $1,386.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.91% from 2.81% late Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |