Search News

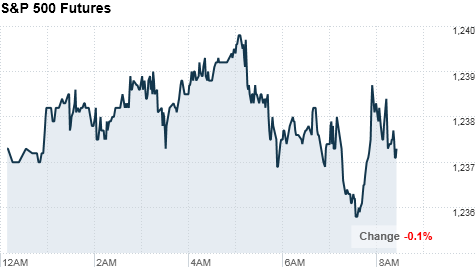

Click on the chart to see other futures data.

Click on the chart to see other futures data.

NEW YORK (CNNMoney.com) -- U.S. stocks were poised to start little changed Friday, as investors mull over the tax-cut deal that was passed by the House late Thursday.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were almost flat ahead of the opening bell. Futures measure current index values against perceived future performance.

Late Thursday, the House of Representatives gave final approval to the $858-billion tax deal hammered out between President Obama and Republicans. The bill passed the compromise by 277-148, and is now awaiting the President's signature. The Senate passed the bill on Wednesday.

"Up until close of business yesterday, there were Democrats in the House saying 'over my dead body,' so the fact that it went through before midnight will be positive for investors," said Peter Bible, partner in charge of the public companies group at EisnerAmper LLP.

On Thursday, stocks closed at two-year highs, with two of the three major indexes hitting their highest levels since September 2008. Stocks ticked higher, as investors digested mixed reports on housing and jobs data that came out before the opening bell Thursday.

Bible is bullish on 2011. "The last couple of years it has been my way or the highway with the White House, and now with the ability to compromise -- I think 2011 looks like it could be a good year."

Economy: After the opening bell, an index on leading economic indicators for November is expected to increase 1.2%, after a 0.5% rise the month before.

Also, a report on regional and state unemployment for November is scheduled to be released after the opening bell Friday.

Companies: After the bell on Thursday, Oracle (ORCL, Fortune 500) and Research in Motion (RIMM) announced their past-quarter financial results -- both beat Wall Street analysts' estimates for earnings and revenue.

Marshall & Ilsley (MI) will be acquired by Canada's BMO Financial in a stock-swap deal valued at $4.1 billion. The transaction is based on a share price of $7.75 -- nearly 34% premium over Marshall & Ilsley's closing price on Thursday. In premarket trading, shares of Marshall & Ilsley jumped 27%.

Other regional banks -- which have been especially hard hit during the recession -- were poised to rally at the open. Regions Financial (RF, Fortune 500), Zions Bancorp (ZION), and KeyCorp (KEY, Fortune 500) were all up in premarket trade.

World markets: European stocks eased in afternoon trading. Britain's FTSE 100 lost 0.2%, the DAX in Germany slid 0.4%, and France's CAC 40 shaved 0.2%.

Eurozone jitters persisted Friday. Ratings agency Moody's downgraded Ireland's debt citing "increased uncertainty regarding the country's economic outlook," "decline in the Irish government's financial strength" and bank related concerns. Earlier in the week, Irish officials accepted IMF funds connected to its €85 billion bailout.

"The downgrade itself was not a surprise -- the severity of it was," Bible said. "They got moved five notches on the ratings scale, so that to me sends a signal that the concerns may be deeper than first realized."

The European Council, comprised of leaders of European Union nations, put out a statement at the conclusion of its two-day meeting in Brussels pledging continued support for eurozone nations. The statement also outlined "a future permanent mechanism to safeguard the financial stability of the euro area as a whole," to be implemented by January 2013.

The statement left investors wondering whether the Eurozone had short-term plans. "It was primarily, substantially geared toward the longer term resolution of issues," Bible said. "What about today?"

Asian markets ended the session mixed. The Shanghai Composite shaved 0.2% and Japan's Nikkei lost 0.1%, while the Hang Seng in Hong Kong added 0.2%.

Currencies and commodities: The dollar was mixed: it gained on the British pound and lost ground against the euro and the Japanese yen.

Oil for January delivery slipped 13 cents to $87.57 a barrel.

Gold futures for February delivery added $4.0 to $1,375.20 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.40%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |