Search News

Click chart more more pre-market data.

Click chart more more pre-market data.

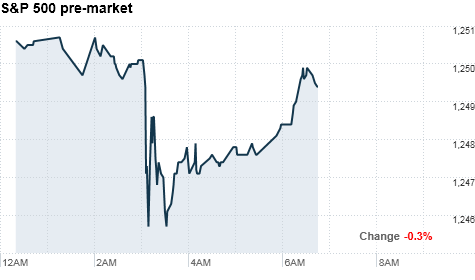

NEW YORK (CNNMoney.com) -- U.S. stocks were set to open lower Monday as investors weighed a surprise interest rate hike in China as the nation struggles to keep its rapid growth and inflation in check.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down ahead of the opening bell. Futures measure current index values against perceived future performance.

"There's not a lot of economic news this week, so investors will be looking at China's move," said Robert Brusca, chief economist at Fact and Opinion Economics.

On Sunday, the People's Bank of China raised its benchmark interest rates by a quarter of a percentage point, increasing its one-year lending rate to 5.81% and the one-year deposit rate to 2.75%.

It was the second hike in just over two months. China raised rates in October for the first time in three years.

"I'm not a big believer that China is that important right now, but a lot of people are concerned that China is slowing down its economy, which would affect the global economy," Brusca said.

While high food prices are driving inflation in China, Brusca noted that other parts of the country's economy, including the housing market, remain strong.

On Thursday, stocks ended a strong week on a quiet note, as mixed economic data kept investors from jumping in ahead of a long holiday weekend.

While markets were closed Friday, stocks are still on track to post double-digit increases for the year.

Trading volume is expected to be extremely light. In addition to the holidays, a major snowstorm in the Northeast will likely keep many Wall Street employees from getting to work.

World markets: European stocks slipped in morning trading. The DAX in Germany and France's CAC 40 both fell more than 1%. Britain's market was closed for a holiday.

Asian markets ended mixed. The Shanghai Composite dropped 1.9% after China's rate hike, while the Hang Seng in Hong Kong lost 0.3%. Japan's Nikkei gained 0.8%.

Companies: Airline stocks came under pressure Monday after carriers were forced to cancel and delay hundreds of flights due to a blizzard that pummeled the East Coast.

Shares of Delta (DAL, Fortune 500), JetBlue Airways (JBLU) and American Airlines' parent company AMR (AMR, Fortune 500) all dipped lower in premarket trading.

Currencies and commodities: The dollar eased against the euro, the Japanese yen and the British pound.

Oil for February delivery slipped 25 cents to $91.26 a barrel.

Gold futures for February delivery rose $1.30 to $1,381.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury declined, pushing the yield up to 3.47% from 3.39% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |