Search News

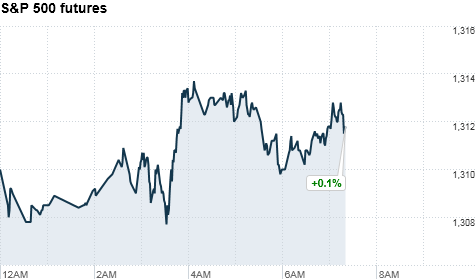

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were set for a solid open Monday, as investors awaited key economic data and continue to focus on global developments.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks managed to head higher last week, as investors turned their attention to strong corporate earnings and shrugged off geopolitical concerns. The Dow gained more than 3%, the S&P 500 gained 2.7% and the Nasdaq surged 3.7%.

Gains last week came despite ongoing concerns about Japan's nuclear crisis, along with continuing unrest in the Middle East and the civil war in Libya.

"We certainly we have a lot to worry about," said Bruce McCain, chief investment strategist at Key Private Bank. "But the market's resilience suggests to me that we will continue to move higher."

McCain said stocks have been supported by improvement in the U.S. economy, including strengthening consumer sentiment and industrial production. He warned, however, that rising inflation worldwide and the simmering debt crisis in Europe could drag on the market later in the year.

"For the moment, the path of least resistance is up," he said.

Investors said the main event this week will be Friday's monthly hiring and unemployment report from the U.S. Labor Department. Economists surveyed by Briefing.com expect the economy created 185,000 jobs in March, and the unemployment rate remained steady at 8.9%.

Economy: The Commerce Department reported that spending by individuals increased 0.7% in February, topping a forecasted 0.5% rise. Personal incomes rose 0.3% in the month, matching expectations.

Additionally, the National Association of Realtors will issue its January pending home sales report at 10 a.m. ET. Pending home sales are expected to increase 0.3%, according to economists surveyed by Briefing.com.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 edged up 0.8%, the DAX in Germany eased 0.2% and France's CAC 40 was little changed.

Asian markets ended mixed. The Shanghai Composite added 0.2% and the Hang Seng in Hong Kong gained 0.4%, while Japan's Nikkei slid 0.6%.

Currencies and commodities: The dollar rose against the euro, the Japanese yen and the British pound.

Oil for May delivery slipped 20 cents to $105.40 a barrel.

Gold futures for April delivery fell $10.60 to $1,415.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.44% from 3.40% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |