Search News

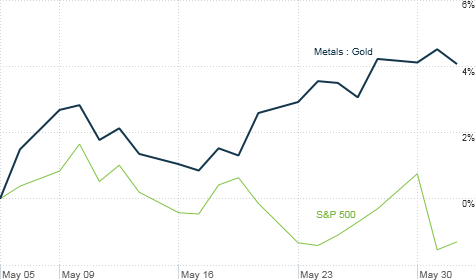

Gold has started to inch higher in the past month as investors in stocks get nervous about the economy. Click chart for more on the markets.

NEW YORK (CNNMoney) -- There is a growing sense of unease about the economy, and investors are starting to flock back to so-called safe havens as a result.

Gold has quietly crept back near $1,530 an ounce, only about 2% below its all-time high set in early May. The yield on the 10-year U.S. Treasury note dipped under 3% Wednesday for the first time since December as investors shunned stocks and scooped up bonds.

Yes, feel free to sing the catchy "Men Without Hats" chestnut from the 1980s. Safety! Dance!

Wednesday's big stock market sell-off was blamed mostly on an incredibly dour jobs report from payroll processor ADP (ADP, Fortune 500). Investors are now biting their nails and wondering whether Friday's jobs report from the government will be just as feeble.

In another sign that investors were running scared, the CBOE Market Volatility Index, or VIX (VIX) for short, surged 18% on Wednesday. The VIX is often referred to as Wall Street's fear gauge.

If that wasn't enough to spook people, there's the added uncertainty about what will happen to the financial markets once the Federal Reserve's latest round of quantitative easing, a bond buying program often dubbed QE2, runs out at the end of the month.

"There are lots of worries about the economy stalling. The markets are going to be looking closely at jobs and the end of QE2," said Bob Gelfond, chief executive of MQS Asset Management, a global macro hedge fund based in New York.

Heck, those who have a fondness for all things ursine are even starting to proclaim this the beginning of a double dip recession.

Now that seems a bit rash at this point.

But more economic weakness could lead to a further rally in gold and maybe even silver -- especially if the European sovereign debt crisis continues to intensify. The euro and dollar seem to be taking turns leading the battle to prove who has the world's ugliest currency.

"Gold and silver are positioned to benefit from the poor market dynamics and economic realities in both the United States and Europe. They are viewed as alternative currencies," said Ashraf Laidi, chief executive officer of Intermarket Strategy Ltd, a London-based research firm.

The economic sluggishness in the United States -- you can add a continuation of the housing slump to the limp job market as a major worry -- should lead to more bond buying and push bond yields even lower.

"There doesn't seem to be a lot of economic growth. Fixed income investors already knew that and the stock market is just starting to figure that out," said Brian Battle, director with Performance Trust Capital Partners, a fixed-income trading firm in Chicago.

Still, what about the end of QE2? Once the Fed stops buying bonds, shouldn't rates edge higher again? There's also the looming deadline for raising the nation's debt limit. Aug. 2 is not that far away and it is looking as if politics as usual could wind up trumping common sense.

Battle isn't concerned. He said investors believe that the voices of reason will ultimately prevail in Congress. As for QE2, Battle said Ben Bernanke isn't the only one that's attracted to bonds.

"The bond market is not worried at all about the debt ceiling debate or the U.S. defaulting. The adults eventually have to take charge," he said. "And there are still willing buyers of Treasuries beyond the Fed."

Howard Chin, co-manager of the RS Low Duration Bond Fund (RLDAX) in New York, agreed. As long as the economy remains sluggish, the safe-haven trade will remain on. Gold goes up and bond yields go down.

"The rally in Treasuries is not surprising at all," Chin said. "There is not much data to support that the economy is getting better in the second quarter, and I wouldn't be surprised if even more people start to ratchet down growth forecasts for the second half of the year."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: