Search News

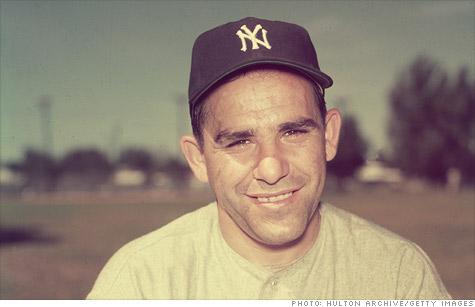

New York Yankees great Yogi Berra famously said, "It ain't over 'til it's over." And that's probably the best response to questions about when the stock sell-off will end.

NEW YORK (CNNMoney) -- Do you want the good news or the bad news first? Good news? Okay.

Even though the Dow plummeted more than 500 points Thursday on global economic worries, market experts say now is not the time to panic.

Now the bad news. Those same experts said that they're not expecting stocks to come roaring back anytime soon either.

Yes, Friday's jobs report was a pleasant surprise. You could argue that Thursday's sell-off might have been due to expectations that the jobs report would be a total stinker. But let's be honest. An increase of 117,000 jobs is hardly robust.

What's more, Europe is still, to use a favorite Project Runway line, a hot mess.

And that's probably why stocks pulled back sharply Friday after a big pop at the open. The Nasdaq fell over 3% at one point in mid-afternoon trading. Stocks finished mixed in what was a wild roller coaster of a day.

Trying to call the bottom here is a dangerous game. Baseball legend Yogi Berra said it best. "It ain't over 'til it's over."

So what are fund managers doing now? Playing it safe. And so should you.

Rob McIver, co-manager of the Jensen Portfolio (JENSX) in Lake Oswego, Ore., said investors need to resist the urge to sell everything. Investors should stick with what they have in their portfolios and maybe add more if they can stomach the near-term risk.

"When you see stocks on sale like they are today, we feel comfortable even though the market is very volatile," McIver said. "Now is the time to have the courage of your convictions and add to your positions of stocks you like."

McIver, whose fund focuses on quality blue chip companies with a long record of strong returns on equity, said that some of the stocks he's most bullish on are PepsiCo (PEP, Fortune 500), United Technologies (UTX, Fortune 500) and Emerson Electric (EMR, Fortune 500).

Mark Coffelt, president & CIO of Empiric Advisors and manager of the Empiric Core Equity Fund (EMCAX) in Austin, said he will also do some buying of stocks today. But not much.

He said that some companies may have been unduly punished on recession fears and those are the kind of stocks that might be good bargains after Thursday's rout. Coffelt cited auto parts makers American Axle and Manufacturing (AXL) and Lear (LEA, Fortune 500) as two stocks his fund owns that have been "unmercifully bashed."

Coffelt also said that, despite the fact that the economy is obviously slowing, affluent consumers may still feel comfortable spending. That could bode well for a company like auctioneer Sotheby's (BID), which is also a holding in his fund.

Other fund managers said that in volatile times like this, it's a good idea to embrace anything that guarantees you a steady stream of income.

Ed Perks, manager of the Franklin Income Fund (FKINX) in San Mateo, Calif., said there are several companies with strong balance sheets that pay dividends that yield more than the 10-year Treasury's puny 2.45%.

Electric utilities Southern (SO, Fortune 500) and PG&E (PCG, Fortune 500) are two examples of stocks Perks owns that have high payouts. Each yield over 4.5%.

These companies are clearly being looked at by investors as safe haven/bond surrogates. Both were up Friday even as the broader market sank. And on Thursday, Southern fell less than 1% while PG&E actually rose slightly.

Perks said Intel (INTC, Fortune 500) and PepsiCo are two other blue chips that he likes thanks to their solid dividends. He added that he expects many more companies with lots of cash to boost their quarterly payouts.

"There are lots of opportunities for dividend growth. It's a more conservative path for companies to take with their cash if they are still worried about uncertainty," Perks said.

Another manager said that, ironically enough, some high-quality corporate bonds are looking more attractive.

"If the persistent worries about the deficit continue to pick up, AAA-rated corporate securities could be a better credit risk than the U.S. government," said Dave Kavanagh, president of Grant Park Funds in Chicago and manager of the Grant Park Managed Futures Strategy Fund (GPFIX).

With that in mind, he said he's starting to look at bonds from companies like Microsoft (MSFT, Fortune 500), Exxon Mobil (XOM, Fortune 500) and Johnson & Johnson (JNJ, Fortune 500). But he's not buying yet. And he's too nervous about the global economy to be buying stocks.

"I am still looking at the big picture negatively. You need to be cautious about buying the first dip. You could quickly see another one," Kavanagh said.

Sadly, based on what happened early Friday, it looks like he's right.

Reader comments of the week. Yes, plural. This market volatility has everyone on edge. One reader likened the wackiness to one of my favorite daytime diversions from the 1980s.

"Remember that TV game show, #PressYourLuck? I feel like we're playing that each week now. 'Come on, big bucks -- no whammies!'" tweeted @IanGertler.

That is awesome. But I had to give co-honors to a former colleague of mine at Red Herring magazine (my last gig before here). I tweeted this morning about Bank of America's stock plunging below $9 and mused about the possibility BofA (BAC, Fortune 500) would have to do a reverse stock split like Citigroup (C, Fortune 500).

That led Scott Raynovich, aka @rayno, to ask this. "Will they change the name to Bank of GoingSouth America?"

Ha. Bank of no opportunity, perhaps?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: