Search News

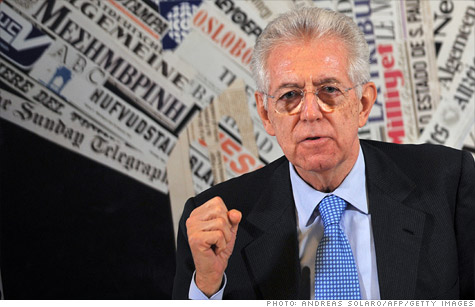

Newly appointed Prime Minister Mario Monti gained final approval last week for a ?30 billion package of austerity measures.

NEW YORK (CNNMoney) -- Weak demand for long-term Italian bonds at its final auction of the year Thursday sent the yield of the country's 10-year debt above the troubling 7% level.

Overall, the auction sold just over €7 billion, or about $9 billion, of long-term bonds, out of an offering range of between €5 billion to €8.5 billion.

Italy will end up paying slightly less for these bonds than at its previous auction a month ago. The auction of 10-year bonds drew a yield of 6.98%, down from 7.56%. But in trading Thursday, the yield on the Italian 10-year edged up to 7.07% from just under 7% the previous day.

A yield of 7% or more for 10-year bonds sets off warning bells among investors since that's widely seen as an unsustainable level that can force a country to seek a bailout, as was the case in Portugal, Ireland and Greece.

Italian yields first topped 7% in November amid fears that Italy could be the next to need a bailout. But yields dropped sharply in the first week of December on hopes that a "fiscal pact" reached by European leaders would become the much needed solution to the long-running debt crisis.

They edged back above the 7% mark a week ago as worries about Italy's bloated debt resurfaced, even as Prime Minister Mario Monti secured final approval for a €30 billion austerity plan.

As the eurozone's third-largest economy, Italy is considered too big to fail. At the same time, with debts of €1.9 trillion, the country may also be too big to bail out, leaving investors on edge.

On the bright side, yields on shorter-dated debt showed marked improvement. The auction of 3-year bonds yielded 5.62%, down from from 7.89% a month ago.

Hopes for a stronger long-term auction were raised Wednesday when the yield for the 6 month notes dropped by more than half to 3.278% from 6.608% a month ago, while the 2-year yield dropped to 4.853% from 7.814% ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: