Oil prices settle below $108

Futures sink as traders remain wary of softening demand, despite a government report announcing a surprising decline in U.S. crude supplies.

NEW YORK (CNNMoney.com) -- Oil prices fell Thursday as investors weighed signs of weakening demand against a government report showing a surprise drop in the nation's supplies of crude.

Light, sweet crude for October delivery fell $1.46 to settle at $107.89 on the New York Mercantile Exchange, after being down as much as $2.83 to $106.52.

The last time crude settled below $108 a barrel was on April 4, when it fell to $106.23 a barrel.

"The overall inventory situation weakened," said Tom Pawlicki, an oil market analyst at MF Global in Chicago. And that would normally be "somewhat bullish for the market."

The Energy Information Administration said in its weekly inventory report that the nation's crude stock piles shrank by 1.9 million barrels last week. Analysts surveyed by energy research group Platts had expected stocks to grow by 500,000.

But the report also showed that imports of crude and gas fell last week, suggesting that demand for petroleum products is continuing to wane.

Refiners imported an average of 9.8 million barrels per day last week, down 149,000 barrels a day from the previous week. Crude imports are now 0.2 million barrels a day below the same four-week period last year.

Gas inventories fell by a million barrels, slightly less than the 1.8 million barrel decline forecast by Platts. And supplies of distillates, used to make diesel and heating fuel, fell by 400,000 barrels; analysts expected an increase of 1.1 million barrels.

Imports of gasoline fell to about 883,000 barrels a day last week. That's down 68% from the previous week's average of about 1.4 million barrels per day.

Last week's decline in imports reflects the industry's preparation for Hurricane Gustav, said Phil Flynn, senior market analyst at Alaron Trading.

"But when it's all said and done, people are realizing that demand is weaker than it has been," he added.

Gulf Storms. On Wednesday, the crude futures contract for October delivery fell 36 cents to settle at $109.35 a barrel, marking the lowest close since the $109.09 finish on April 7, and following a $5.75-a-barrel drop on Tuesday.

Hurricane Gustav slammed into the Louisiana coastline Monday after barreling through the Gulf of Mexico. The storm sent shivers through the oil market because the Gulf waters are home to one quarter of U.S. oil production rigs, and dozens of refineries sit along the coastline.

While Gustav did not cause as much damage as was initially feared, oil companies were sending out crews to fully inspect rigs. The oil industry appears to have mostly moved on from Gustav, according to Neal Dingmann, senior energy analyst at Dahlman Rose & Co.

At this point, "it would be a surprise to the market if the MMS (Minerals Management Service) reported there was a fair amount of damage," said Dingmann.

As of Thursday afternoon, 95.2% of crude oil production and 87.5% of natural gas production in the Gulf of Mexico remained shut down, according to a report from the U.S. Department of the Interior's Minerals Management Service. Both oil and gas production in the Gulf were down by the same percentages on Wednesday.

Thursday's supply report was for the week ended Aug. 29 and therefore did not fully show the impact of Gustav. Next week's supply report "will bear the impact from the shut-ins related to Gustav," wrote Stephen Schork in his industry newsletter, The Schork Report.

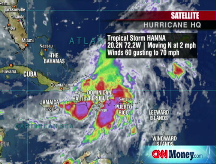

As oil companies assessed damage from Gustav, Hurricane Ike became a Category 4 hurricane Wednesday night, according to the National Hurricane Center, with winds of 135 miles per hour. The storm is currently not on track to hit the Gulf of Mexico.

However, Dingmann said he spoke to an oil company with rigs in the Gulf that was paying close attention to the movement of Hurricane Ike and Tropical Storm Hanna.

Oil-market watchers were also waiting for the Sept. 9 meeting of the Organization of the Petroleum Exporting Countries. With oil prices sharply off the record high of $147.27 a barrel, set July 11, Dingmann said the market is wondering whether OPEC would cut its production limit.

"As soon as they begin cutting, it is very likely you could see prices rise again," said Dingmann, because of "simply having less supply in the market."

The dollar continued to climb against the euro and other major currencies, putting downward pressure on oil prices. ![]()