Dow comes back big

The third-highest point gain ever for the blue-chip measure comes on bets that a bailout plan can get passed.

NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday, with the Dow jumping 485 points on bets that Congress will pass a version of the government's $700 billion package, following Monday's crushing defeat.

But credit markets remained frozen. Several closely watched measures of bank lending fear hit all-time highs, as firms continued to hoard funds.

The Dow Jones industrial average (INDU) added 485 points, recovering much of the record 777 points lost the day before. It was the third-biggest one-day point advance for the indicator in its history.

The Standard & Poor's 500 (SPX) index rose 5% and the Nasdaq composite (COMP) gained about 5%.

Stock gains accelerated late in the day after the FDIC - the agency that insures depositors in case of a bank failure - said it wants to increase the amount of money it can insure.

Raising the limits could make businesses and individuals less anxious to withdraw money from accounts at a struggling bank. It could also help get the $700 billion plan passed by mollifying critics who think the plan is too focused on Wall Street, rather than Main Street. (Full story)

Later Tuesday evening, Senate leaders said they expected to vote on a version of the bailout bill on Wednesday, with new provisions that include a lifting of the FDIC limit.

But the actual impact from any increase in the insurance would be more psychological than anything else, said Brian Battle, vice president at Performance Trust Capital Partners. "They're trying to make bank deposits more sticky so people won't pull money out."

At around the same time, the SEC and FASB - which monitors accounting standards - said it will announce guidance later this week on how financial companies can use fair-value accounting, which some have blamed for the escalation of the liquidity crisis. Fair value, or mark-to-market accounting, says all assets have to be valued at what price they could be sold at immediately. When a company that is struggling sells assets cheap to raise money, it drags down prices for the overall market.

Some critics have said temporarily suspending this rule would help the market for such securities gradually move higher. The failed version of the $700 billion bill alluded to the potential for changes in those accounting rules.

Battle said he thinks the agencies were trying to hedge their bets in case the newest version of the bill calls for a temporary suspension of the rules.

Tuesday's advance marked a readjustment on the part of investors, as they moved beyond the panic of Monday's historic selloff, said Matt King, chief investment officer at Bell Investment Advisors.

"I think people are realizing that yesterday's selling was overdone in terms of the fear," he said.

That fear stoked a mass of sell orders near the close Monday, leading to Tuesday's rally or "dead-cat bounce," said Alan Lancz, director of Lancz Global.

"If the government thought it could make Wall Street a promise and then take it away, Monday showed them otherwise," King said.

He noted that in the previous week, when the bailout was first announced, the Dow rallied roughly 800 points in two sessions. But when the bailout appeared to be off the table, the Dow gave back almost all of that.

Despite Tuesday's gains, September easily earned its reputation as the worst month on Wall Street, according to Stock Trader's Almanac.

All three major gauges fell in September and for the third quarter. (For details, click here.)

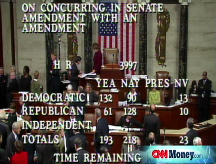

Bank rescue plan: Stocks plunged Monday after the House of Representatives shot down the proposed $700 billion bank rescue plan, surprising investors who had thought that a bipartisan compromise on the deal had been reached over the weekend.

The plan involves the Treasury Department buying up bad mortgage bets from banks, enabling them to start lending to each other again and ultimately defrosting the credit markets. Lawmakers had fought to modify the plan with more taxpayer protections.

However, taxpayers were not entirely swayed, and voter complaints about the plan ahead of the election contributed to a majority in the House voting against the proposal. (Full story)

Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and other officials conceived the plan in the wake of a series of bank failures and mergers amid the housing market collapse and subsequent credit market freeze up. Frozen credit markets mean banks cling to cash, making it difficult for businesses and individuals to get needed loans.

Stocks were down Monday ahead of the vote on bets that either the plan wouldn't get Congressional approval, or even if it did, that it wouldn't be enough to relieve credit markets. On Tuesday, President Bush urged lawmakers to take action on the bill when they return to Washington on Wednesday.

"While the plan is far from perfect, it would have established a floor, given the markets confidence and helped to unclog the credit markets," Lancz said.

He said that the longer it takes for a plan to be enacted, the worse the impact it has on both the domestic and global economies.

The Dow's 7% decline Monday was the worst single-day percentage drop since Sept. 17, 2001 - the first trading day after the September 11 attacks. The S&P and Nasdaq both lost around 9%, the biggest single-day percentage drop since the October 1987 crash.

The day's loss knocked out roughly $1.2 trillion in market value, according to a drop in the Dow Jones Wilshire 5000, the broadest measure of the stock market. It was the first time markets have ever lost more than $1 trillion in a day.

But markets gained back roughly $600 billion Tuesday, according to Dow Wilshire estimates.

Credit markets: The credit markets remained tight Tuesday.

Libor, the rate banks charge each other for overnight dollar loans, hit a record 6.8%, the highest level since tracking began in 1984, according to the British Bankers' Association.

The Libor-OIS spread, a cash scarcity gauge, rose to an all-time high.

But the TED spread, an indicator of credit risk, fell to 3.15% from a 26-year high of 3.58% Monday, indicating a slight easing of the market. The TED spread is the difference between what banks charge each other to borrow for three months and what the Treasury pays.

If banks are relatively confident, they should charge each other not much more than the U.S. government. When the spread widens, that indicates rising jitters.

The yield on the 3-month Treasury bill, seen as the safest place to park money in the short term, rose to 0.88% from 0.14% late Monday. Earlier this month, the three-month bill fell to a 68-year low around 0% as panic gripped financial markets. (Full story)

Government debt prices weakened and the yields rose. The benchmark 10-year Treasury note fell 1-27/32 after several up sessions, pushing the corresponding yields up to 3.82% from 3.60% Monday. Treasury prices and yields move in opposite directions.

On the move: Many of the financial services stocks that tumbled Monday bounced back Tuesday.

Bank of America (BAC, Fortune 500) rose 15.7%, JPMorgan Chase (JPM, Fortune 500) climbed 14%, Merrill Lynch (MER, Fortune 500) added 15% and Morgan Stanley (MS, Fortune 500) gained 9.6%.

Wachovia (WB, Fortune 500) rallied 94% Tuesday after sliding over 80% Monday on news that Citigroup (C, Fortune 500) is buying the company's bank assets in a $2.2 billion all-stock deal. Citigroup gained 16%.

A rise in oil prices gave a lift to the underlying stocks, with Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), Halliburton (HAL, Fortune 500) and Schlumberger (SLB) all rallying.

Trading volume was moderate following Monday's blowout. On the New York Stock Exchange, advancers beat decliners 4 to 1 on volume of 1.62 billion shares. On the Nasdaq, winners topped losers by more than 3 to 2 on volume of 2.43 billion shares.

Portfolio managers' end-of-quarter reshuffling can sometimes cause increased volatility and volume in the last few days of the quarter. But not so this time, with the rescue plan's surprise setback dominating trade.

Third quarter: Tuesday was the last day of an abysmal third quarter, in which worries about the health of the financial sector knocked down 9 of the 10 S&P economic sectors and all three major gauges.

Surprisingly, many financial sector stocks did well, bouncing after getting pummeled in the first two quarters of the year. The Dow 30's biggest gainers were Bank of America and JPMorgan Chase, both up over 30%.

For the quarter, the Dow lost around 4.4%, the Nasdaq fell 9.2% and the S&P 500 lost 9%., with most of the declines happening in September.

Economic news: A closely watched measure of the housing sector showed that home prices in July fell by the largest rate ever, although the pace of monthly declines slowed. (Full story)

The Chicago PMI, a key manufacturing report, fell to 56.7 in September from 57.9 in the prior month. However, the decline was smaller than economists were expecting. Any reading over 50 suggests growth.

The September consumer confidence index topped forecasts, the Conference Board reported. It climbed to 59.8 from a revised 58.5 in August, surprising economists who thought it would fall to 55.

Oil and gold: U.S. light crude oil for November delivery rose $4.27 to settle at $100.64 per barrel on the New York Mercantile Exchange. On Monday, oil prices plunged $10.52 a barrel in the second-biggest one-day plunge ever. (Full story)

Oil prices had plummeted over $55 after peaking at $147.27 a barrel on July 11, as investors bet that sluggish global growth will diminish oil demand. But the recent acceleration of the financial crisis had caused investors to buy up commodities in a safer-haven play.

COMEX gold for December delivery fell $13.60 to settle at $880.80 an ounce. Like oil, gold prices rallied during the biggest periods of unrest over the last few weeks

Other markets: In currency trading, the dollar fell against the euro and gained against the yen.

Gas prices fell for the 13th day in a row, according to a nationwide survey of credit card activity.

In global trading, Asian markets tumbled on the back of the U.S. selloff Monday. European markets rose Tuesday. ![]()