How Fortune foresaw a GM bankruptcy

The author of 2006's 'The Tragedy of General Motors' recalls coming to a painful conclusion about the once-great automaker.

NEW YORK (Fortune) -- My writing assignment in the winter of 2005-06 was to give Fortune's readers my opinion as to whether General Motors would go bankrupt. I reported the article for about nine weeks, going to Detroit three times and talking there and in New York to GM executives, analysts and car people of all kinds. I tried many times over to set up an appointment with Ron Gettelfinger, head of the United Automobile Workers. But he wouldn't agree to an interview, perhaps because of a story I had written earlier about Bethlehem Steel that he thought was unfriendly to unions (I didn't agree).

When all the reporting was done and I had reviewed all my notes, I stared at my computer screen and agonized over what I should say (though I must admit to also agonizing over everything I've ever written). I neither wished to say that GM (GM, Fortune 500) was going to go bankrupt nor that it wasn't. I wanted to equivocate - to say that it was going to be a tough road for GM, but that it might somehow make it. And that's what I said in the opening paragraphs of the first draft I turned in.

My managing editor, Eric Pooley, came back to me the next day, praised much of the story, but said unequivocally that equivocation wouldn't work. "You've been on this story a long time; you've talked to a raft of people; you know the numbers; you've had time to think," he said. "You owe the reader your straight-out opinion about whether bankruptcy is in the cards or is not."

I went back to my computer and reluctantly faced up to what I'd tried to duck. When it came right down to it, when the managing editor was saying fish or cut bait, there was no doubt about where I stood: I did not think that GM could make it.

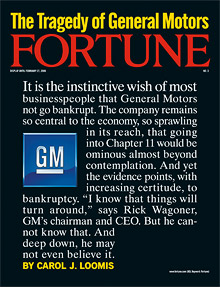

I then wrote the words you see on the cover at right, in the issue of Fortune containing "The Tragedy of General Motors" (Feb. 20, 2006). "The evidence points, with increasing certitude, to bankruptcy. 'I know that things will turn around,' says Rick Wagoner, GM's chairman and CEO. But he cannot know that. And deep down, he may not even believe it."

Today, with bankruptcy forestalled by government billions, but with President Obama saying it may yet come, I recall in particular two facts - out of the catalog of negatives existing - that forced me to my opinion. One was the never-ending decline in GM's North American market share and the related remark of a candid GM executive, which appears in the third paragraph of the article: "There's no fix for us unless we get revenues stabilized."

For a brief time after that, revenues strengthened a little, rising by 8% in 2006, to $207 billion. But in a sign that things still weren't working, the company failed to take advantage of that upturn, running a $2 billion loss that year. And then, as the credit crisis and rising energy prices grabbed hold of the economy, revenues fell out of bed, dropping in 2008 to $148 billion. For 2007 and 2008 combined, the company reported a horrendous $69 billion of losses.

The other reporting fact that has particularly stayed in my mind was the summation of an auto mechanic, Don Freda, a suburban New Yorker who has fixed my family's cars for more than 50 years and who, in his independent repair operation, sees every brand there is. Stopping by his shop, I asked him what he thought of the quality of GM's cars. "They're very good," he answered. "They don't break like they used to." Then, in a flash, he added, "But nobody will buy them."

Three years after our article was published, that is still the unfortunate case. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More