Wall Street stumbles into September

Stocks plunge on worries that the market gains have raced ahead of any economic recovery. Dow down 185 points; S&P 500, Nasdaq sink 2%.

|

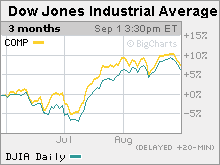

| The Dow has rallied 11.7% this summer. |

NEW YORK (CNNMoney.com) -- Markets tumbled Tuesday, as investors retreated at the start of what is typically a rough month, betting that the six-month stock advance has raced ahead of the economic recovery.

"I think we've had a nice run and it's time for a bit of a pullback," said Tom Schrader, managing director at Stifel Nicolaus. "I wouldn't be surprised if we moved back to the 880 level (on the S&P 500) before moving back up."

A drop to the 880 level would constitute a slide of about 12% from the current levels.

Investors nitpicked through the morning's better-than-expected reports on housing and manufacturing but found little reason to jump back into the fray.

The Dow Jones industrial average (INDU) lost 186 points, or almost 2%. The S&P 500 (SPX) index fell 23 points, or 2.2%. The Nasdaq composite (COMP) fell 40 points, or 2%.

"I think the 'whisper number' for [the manufacturing report] was higher and once people digested that, the market swung in the other direction," said Schrader.

Schrader said that investors were also reacting to the "calendar influence," amid a variety of reports about the tendency for September to be a weak month on Wall Street. September is typically the biggest percentage loser of the month for the Dow, S&P 500 and Nasdaq composite, according to the "Stock Trader's Almanac."

"The reports this morning were positive, but investors are basically saying that stocks have had a good run up and now it's time to take some profits," chimed in Phil Orlando, chief equity market strategist at Federated Investors.

Stocks have essentially been on the rise since March, as investors have welcomed extraordinary fiscal and monetary stimulus and signs that corporate profits and the economy have stabilized. The major gauges ended last week at the highest levels in 9 to 10 months. Financial shares took a beating Tuesday after enjoying a nice ride through the late summer, fueled largely by speculation and momentum.

But with the S&P up 52% from the March 9 lows, market participants are now looking for concrete evidence that the economy is recovering. The morning's reports were positive, but perhaps not as positive as the most optimistic forecasts.

Wednesday preview: Two readings on the labor market are due Wednesday in the lead up to Friday's big August jobs report.

Payroll services firm ADP is expected to report that employers in the private-sector cut 246,000 jobs from their payrolls in August after cutting 371,000 in July.

Additionally, Challenger, Gray & Christmas, an outplacement firm, will report on the number of announced job cuts in August.

A July reading on factory orders is also due in the morning from the Commerce Department. Other reports include the minutes from the last Federal Reserve policy meeting, the weekly crude oil inventories report and the July reading on factory orders.

Manufacturing: The Institute for Supply Management's manufacturing index for August showed growth in the sector for the first time since January 2008. The index rose to 52.9 from 48.9 previously. Economists surveyed by Briefing.com thought it would rise to 50.5.

Pending home sales rose for the sixth straight month, jumping 3.2% in July, to the highest point in nearly two years, according to a report from the National Association of Realtors released Tuesday morning. The index rose 3.6% in June. Economists surveyed by Briefing.com thought sales would rise 1.5% in July.

Construction spending fell 0.2% in July versus forecasts for an unchanged reading. Spending rose a revised 0.1% in June.

Financials: Many of the summer's big bank sector winners led the declines Tuesday.

Dow component Bank of America (BAC, Fortune 500) slipped 6.4% in active NYSE trading. BofA was the biggest Dow gainer in the June through August period, rising 56%.

Dow component American Express (AXP, Fortune 500) lost 5.4% Tuesday. Over the last three months, AmEx has gained 36% and was the second-best Dow performer.

Dow component JPMorgan Chase (JPM, Fortune 500) lost 4.1% after rising 17% this summer.

Among other movers, Citigroup (C, Fortune 500) lost 9% after rising 34% in the summer. Regional bank Fifth Third Bancorp (FITB, Fortune 500) lost 6.2% after rising 59% this summer.

The KBW Bank (BKX) index fell 5.8% after rising 20% over the summer.

Oil prices and stocks: U.S. light crude oil for October delivery fell $1.91 to settle at $68.05 a barrel on the New York Mercantile Exchange. Oil prices have been slipping since hitting a ten-month high just below $75 a barrel late last month.

The decline in oil prices dragged on heavily-weighted energy stocks including Dow components Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500).

Auto sales: The government's popular Cash for Clunkers program gave a boost to sales in August, major automakers said. Although a plunge in sales in the last week of the month, following the program's end, suggests the impact will not be far reaching.

In August, Ford Motor (F, Fortune 500) reported that sales jumped 17% versus a year ago, its best monthly gain in 4 years. However, the advance was short of expectations for a rise of 22%, according to analysts surveyed by Edmunds.com.

Toyota, which had the most Clunker sales of any automaker, said August sales rose 6%, its first year-over-year gain in 16 months.

General Motors (GM, Fortune 500) and Chrysler Group both reported year-over-year declines in August on sales that improved from July.

Company news: Online auctioneer eBay (EBAY, Fortune 500) said it will sell a large stake in its Skype Internet phone business to a group of investors for $2.75 billion.

World markets: European markets tumbled, while Asian markets ended higher. On Monday, a selloff in Chinese markets sparked a broader global selloff.

Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.37% from 3.40% late Monday. Treasury prices and yields move in opposite directions.

Other markets: COMEX gold for December delivery rose $3.50 to settle at $957 an ounce.

In currency trading, the dollar gained versus the euro and the Japanese yen.

Market breadth was negative. On the New York Stock Exchange, losers beat winners by five to one on volume of 1.63 billion shares. On the Nasdaq, decliners topped advancers by almost four to one on volume of 2.81 billion shares.

How does your portfolio look nearly one year after the collapse of Lehman Brothers? What investment choices hurt you or helped you the most? What strategy changes are you making for the future? Tell us your story. E-mail realstories@cnnmoney.com and your thoughts could be part of an upcoming story. For the CNNMoney.com Comment Policy, click here. ![]()