Stocks end at 2009 highs

Wall Street cheers as strong debt auction, P&G forecast, Geithner comments and drop in jobless claims draw investors.

|

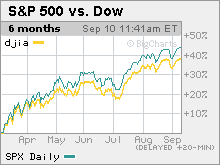

| Since bottoming March 9, the S&P 500 has gained 54%, while the Dow Jones industrial average has gained 47%. |

NEW YORK (CNNMoney.com) -- Stocks surged Thursday, with the major gauges ending at the highest point in nearly a year, having responded strongly to a debt auction and Procter & Gamble's improved forecast.

The Dow Jones industrial average (INDU) gained 80 points, or 0.8%, closing at the highest point since last Oct. 6.

The S&P 500 (SPX) index rose 11 points, or 1%, closing at the highest point since Oct. 6. The Nasdaq composite (COMP) added 24 points, or 1.2%, closing at the highest point since Sept. 26.

All three major indexes have now risen for five consecutive sessions, extending the six-month old stock market advance. Since bottoming March 9 at a 12-year low, the S&P 500 has risen 54% as investors have gone from pricing in a depression to a recession to a recovery.

A combination of a weaker dollar, rising commodity prices and old-fashioned skepticism has fueled the latest leg of the advance, said Paul Brigandi, vice president of trading at Direxion Funds.

"The train of thought through the end of August was that the advance was not justified by the fundamentals, the fall is typically weak and so stocks will sell off," Brigandi said. "But the stock market has a tendency to do the opposite of what everyone is thinking."

He said this skepticism is likely to keep fueling gains.

While the gains so far in September have pushed the S&P 500, Nasdaq and Dow to fresh highs, the advance has been pretty tepid, suggesting investors are taking baby steps.

More than a reaction to any specific news of the day, the rallying of late has been momentum driven, said Joe Saluzzi, co-head of equity trading at Themis Trading.

"All the problems that got us into this mess haven't disappeared, but from a day-to-day standpoint, that doesn't matter," he said. "The path of least resistance is still up."

Stocks got an extra jolt after Treasury's auction of $12 billion in reopened 30-year bonds generated better-than-expected demand. The U.S. is relying on debt auctions to help offset the deficit.

Friday brings the September consumer sentiment index from the University of Michigan, the July wholesale inventories report from the Commerce Department and August import and export prices. The August Treasury budget is due in the afternoon.

Economy: The number of Americans filing new claims for unemployment fell by 26,000 last week to 550,000, according to a Labor Department report released Thursday. That surprised economists who expected 560,000 new claims, according to Briefing.com.

Continuing claims, which measure the number of Americans who have been receiving benefits for a week or more, showed a surprise drop to 6,080,000 from 6,234,000 in the previous week.

The U.S. trade gap widened to $32 billion in July from $27.5 in June, according to a Commerce Department report. Economists thought it would narrow to $27.3 billion.

Foreclosure filings in August dropped 0.5% from July, according to RealtyTrac, an online marketer of foreclosed properties. The number of homes repossessed from borrowers fell by 12.7% in August.

Also helping: Treasury Secretary Timothy Geithner, speaking before the Congressional Oversight Panel, said that the focus is shifting from rescuing the economy to preparing for growth. He also said it isn't likely that more bank bailout money will be needed.

Health care: President Obama outlined his health care plan before a joint session of Congress Wednesday night. The plan, which could cost as much as $1 trillion over a ten-year period, includes requiring all Americans to have health care.

Company news: Dow component Procter & Gamble (PG, Fortune 500) said that it expects sales to improve in the next quarter, sending shares 4.2% higher.

The maker of Tide, Crest and other consumer products said sales in the fiscal second quarter should rise 1% to 4%. Current-quarter sales are expected to be flat to down 3%. Also, in the current quarter, P&G said it still expects earnings per share of 95 cents to $1. Analysts are expecting a profit of 97 cents per share.

Chip maker Texas Instruments (TXN, Fortune 500) said it expects to report a bigger profit in the third quarter than it previously forecast. TI said it will earn between 37 cents and 41 cents per share versus its earlier forecast of 29 cents to 39 cents per share. The company expects sales in a range of $2.73 billion to $2.87 billion, versus its earlier forecast of $2.5 billion to $2.8 billion.

Shares were barely changed.

Monsanto (MON, Fortune 500) said it expects 2010 earnings in a range that is well below analysts' estimates, due in part to an excess of herbicide supply. The world's leading seed maker said it expects fiscal 2010 earnings per share of $3.10 to $3.30. Analysts currently expect earnings of $4.10. Shares fell 5%.

General Motors is selling a major stake in its European Opel division to a consortium led by Canadian auto supplied Magna. Opel is GM's biggest-selling brand in Europe.

Currency: The dollar resumed its slide against other major currencies, falling to a fresh seven-month low against the yen and a nearly 12-month low versus the euro.

Oil and gold: The weak dollar has boosted oil, gold and other dollar-traded commodity prices. Those prices have also been on the rise on bets of a global economy recovery.

U.S. light crude oil for October delivery rose 63 cents to settle at $71.94 a barrel on the New York Mercantile Exchange, seesawing after the government's weekly oil inventories report.

COMEX gold for December delivery fell 30 cents to $996.80 an ounce, after topping the key $1,000 level during the day for the third session in a row.

Bonds: Treasury prices rallied, lowering the yield on the benchmark 10-year note to 3.35% from 3.47% late Wednesday, following the results of the auction.

Wednesday's auction of $20 billion of ten-year notes saw solid demand as well.

World markets: Global markets were mixed. In Europe, London's FTSE 100 and France's CAC 40 both slipped, while the German DAX managed a gain. Asian markets ended higher, with the Japanese Nikkei rising almost 2%.

Market breadth was positive. On the New York Stock Exchange, winners topped losers by over three to one on volume of 1.49 billion shares. On the Nasdaq, advancers topped decliners two to one on volume of 2.49 billion shares. ![]()

Insiders sell like there's no tomorrow

Taxpayers will lose on auto bailouts

Holler if you like the dollar. Anyone?

Fix healthcare. But fix the deficits, too

Wells Fargo: Good bank or bad bank?

Unemployment rate rises again

Small business staff cuts

Bernanke: Fed's unlikely risk taker

New home sales blast past expectations

100 Fastest-growing companies

America's best places to live

50 years of profit swings