Stocks bounce back

Wall Street advances after the previous week's selloff, getting a lift from mergers involving Abbott and Xerox.

NEW YORK (CNNMoney.com) -- Stocks surged Monday, recharging their recent advance after a one-week break, as a pair of multi-billion dollar merger announcements gave investors a reason to get back into equities.

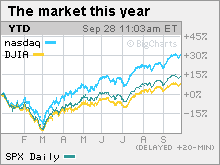

The Dow Jones industrial average (INDU) gained 124 points, or 1.3%. The S&P 500 (SPX) index rallied 19 points, or 1.8%. The Nasdaq composite (COMP) rose 40 points, or 1.9%.

Last week, the S&P 500 fell more than 2%, in its biggest one-week selloff in nearly 3 months. The declines occurred as investors mulled weaker-than-expected housing reports and an as-expected Federal Reserve decision to hold interest rates steady.

But over the last 7 months, investors have mostly used the dips as an opportunity to get back into stocks at lower levels, something that happened Monday, too.

"The two big mergers really hammer home the point that the credit market is improving," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research.

He said merger news and the recent series of initial public offerings that have come to market go a long way to counter worries that the stock advance is out of pace with the still-sluggish economy.

"These are bullish signs," he said.

Since bottoming at a 12-year low March 9, the S&P 500 has gained 57% and the Dow has gained 49.5%, as of Monday's close. After hitting a six-year low, the Nasdaq has gained 68%.

Stock gains were broad-based Monday, with 28 of 30 Dow components rising, led by Boeing (BA, Fortune 500), 3M (MMM, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), Johnson & Johnson (JNJ, Fortune 500) and Travelers Companies (TRV, Fortune 500).

The only stocks that didn't gain were IBM (IBM, Fortune 500) and Kraft Foods (KFT, Fortune 500).

Tuesday preview: Tuesday brings readings on consumer confidence from the Conference Board and the 20-city home price index from Case-Shiller.

Tuesday is also the one-year anniversary of the Dow's biggest one-day point loss of all time. On that day, the average plummeted 777.68 points, and the broad market knocked out $1.2 trillion in value. The plunge occurred after the House of Representatives rejected the government's then $700 billion bank bailout plan as a number of banks around the globe teetered on the brink of collapse.

Deal news: Abbott Laboratories (ABT, Fortune 500) is buying the drug unit of its development partner, Belgian pharmaceutical company Solvay, for about $6.6 million in cash. Abbot shares rose 2.6%.

Xerox (XRX, Fortune 500) is buying Affiliated Computer Services (ACS, Fortune 500) for $6.4 billion in cash and stock. Shares of Xerox lost 14.5%, while shares of Affiliated, an outsourcing firm, gained 14%.

Private equity firm American Securities said it is buying GenTek (GETI) for $411 million in cash. GenTek makes specialty chemicals and engine parts.

Johnson & Johnson (JNJ, Fortune 500) bought an 18% stake in biotech firm Crucell for $444 million as part of a deal to develop a flu vaccine.

Often, deal news lifts the broad market as it is seen as a sign of corporate confidence.

World markets: Global markets were mixed. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all gained. Asian markets ended lower, with the Japanese Nikkei losing 2.5%.

Currency and commodities: The dollar rose versus the euro and fell versus the yen. The greenback has repeatedly hit one-year lows against a basket of currencies over the last few weeks.

U.S. light crude oil for October delivery rose 82 cents to settle at $66.84 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery rose $2.50 to settle at $994.10 an ounce. Gold closed at a record high of $1,020.20 two weeks ago.

Gas prices dropped below $2.50 a gallon for the first time since late July on rising supplies and diminishing demand.

Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.28% from 3.32% late Friday. Treasury prices and yields move in opposite directions.

Trading volume was light because of the Jewish holiday of Yom Kippur.

Market breadth was positive. On the New York Stock Exchange, winners topped losers four to one on volume of 978 million shares. On the Nasdaq, advancers topped decliners three to one on volume of 1.93 billion shares. ![]()

Microsoft stages a big comeback

G-20 summit: 6 countries in recovery

Fed: Economic activity has 'picked up'

Fighting off the Bear: Seven stories

5 lessons from the crash

50 Most Powerful Women

Bernanke: Fed's unlikely risk taker

100 Fastest-growing companies

50 years of profit swings