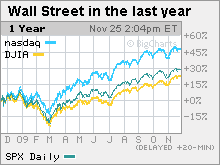

Dow hits new '09 high ahead of holiday

Both the blue-chip average and the S&P 500 end at 13-month peaks after reports show improvement in labor market, new home sales and consumer spending.

NEW YORK�(CNNMoney.com) -- Stocks climbed Wednesday in a thinly-traded session ahead of Thanksgiving, as investors welcomed a bigger-than-expected drop in weekly jobless claims.

All financial markets are closed Thursday for the holiday, while Friday brings an abbreviated session for stocks. Some market pros will make a five-day weekend of the period.

The Dow Jones industrial average (INDU) rose 31 points, or 0.3%, ending at a fresh 13-month high. The S&P 500 (SPX) rose 5 points, or 0.5%, and also finished at a fresh 13-month high.

The Nasdaq composite (COMP) rose 7 points, or 0.3%, closing short of a 13-month high.

Because of the holiday, all the week's news was jammed into the first three days, with nothing on the docket Friday.

The combination of a three-day onslaught of economic news and some pre-holiday wariness was keeping investors from moving much Wednesday, said John Canally, economist at LPL Financial.

"If we had gotten the jobless claims report only, stocks would be up more," said Canally. "But investors are in a data overload this week and it's only going to continue next week."

Next week is a doozy, with reports due on manufacturing, auto sales, housing and the labor market.

Monday's trading will be heavily influenced by how the holiday shopping period kicks off. Black Friday, the day after Thanksgiving, and Cyber Monday, the first work day after the holiday, are critical barometers for the health of the consumer at the start of the biggest shopping period of the year.

Most economists believe the recession is over. Yet rampant joblessness, lower household income and personal wealth, and a still-tight lending environment should temper the benefit of retailers' discounts.

Overall spending is expected to hit a range of between 1% lower than a year ago and 1.5% higher. Canally said that it's likely to hit the higher end of that range.

Wall Street ended Tuesday's choppy session lower as investors retreated from 13-month highs hit the day before.

Jobs: New claims for unemployment posted a surprisingly large tumble last week, falling to 466,000, a 14-month low. Economists surveyed by Briefing.com thought claims would drop to 500,000 from a revised 501,000 the previous week.

Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 5,423,000 from a revised 5,613,000 the previous week. Economists expected 5,565,000 claims.

New home sales: Sales rose to a 430,000 annual unit rate in October from a 405,000 unit rate in September. Economists expected sales to dip to a 404,000 annual unit rate.

Income and spending: Personal income and spending climbed in October, according to a Commerce Department report released in the morning.

Income rose 0.2% after rising 0.2% in September. Economists thought it would rise 0.1%, according to Briefing.com estimates. Spending was up 0.7% after falling 0.6% in the previous month.

A separate report showed that orders for durable goods fell 0.6% in October, surprising economists who were expecting orders to rise 0.5%. Orders for goods meant to last three years or more gained 2% in September.

World markets: Global markets advanced. In Europe, London's FTSE 100, Germany's DAX and France's CAC 40 all gained modestly. Asian markets ended higher.

Currency and commodities: The dollar slipped against the euro and gained versus the yen.

The weaker dollar boosted dollar-traded gold, which hit a new record.

COMEX gold for December delivery rose $21.20 to a record settlement of $1,187 an ounce. Gold hit $1192.80 during the session, moving ever closer to the $1200 mark.

U.S. light crude oil for January delivery rose $1.94 to settle at $77.96 a barrel on the New York Mercantile Exchange.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.26% from 3.30% Tuesday. Treasury prices and yields move in opposite directions.

Market breadth was positive and volume was light. On the New York Stock Exchange, winners topped losers two to one on volume of 800 million shares. On the Nasdaq, decliners beat advancers seven to six on volume of 1.42 billion shares. ![]()