Search News

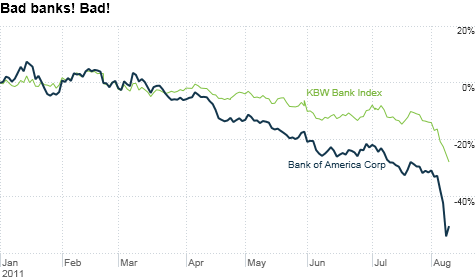

Shares of many banks have taken it on the chin this year as the economy slows. But Bank of America has been hit particularly hard due to legal worries.

NEW YORK (CNNMoney) -- Bank of America and other big financials are getting tarred and feathered by investors lately. And despite a rebound Tuesday, it may not get that much better anytime soon.

Shares of Bank of America (BAC, Fortune 500) have plummeted nearly 43% this year and about 20% in just the past week. And that includes the 17% bounce Tuesday.

Insurer AIG (AIG, Fortune 500) dropped a bomb Monday when it sued Bank of America alleging "billions of dollars of damage" tied to what it claims were fraudulent mortgage securities sold by BofA units.

And while other banks don't have the same legal woes as BofA, their stocks are getting killed too. JPMorgan Chase (JPM, Fortune 500), Citigroup (C, Fortune 500), Goldman Sachs (GS, Fortune 500), Wells Fargo (WFC, Fortune 500) and Morgan Stanley (MS, Fortune 500) are all still nursing big losses over the past five days and year-to-date.

But how bad is it really for the banks right now? Many bank experts are quick to point out that this is not the autumn of 2008 all over again. Still, it seems reasonable to worry about the near-term future of the financial sector.

The good news is that many big banks learned their lesson from 2008. They have cut back on risky loans (some would argue they've also cut back on lending to credit-worthy borrowers though) and have raised more cash to avoid future credit crunches.

Pretty much all the big banks have higher Tier 1 capital ratios -- one of the most widely cited measures of a bank's financial health and ability to withstand risk --now than in the third quarter of 2008. That's true for BofA as well.

"Most of the banks reported in the second quarter that they have an unusually high level of capital built up. And asset quality is improving, which is the opposite of what happened in 2008," said Frank Barkocy, director of research with Mendon Capital Advisors, a New York money manager that focuses on financial stocks.

"The comparisons to 2008 are unfair," he added.

Hopefully, that means that BofA or other big banks will not need more "exceptional assistance" from the government. It's hard to fathom anyone in Washington agreeing to TARP, Part Deux at a time when cutting the deficit is arguably the sole economic focus.

But even if the banking sector doesn't lead the broader economy into a tailspin, it may be a case of the broader economy causing another big swoon pullback (Note to my usual Buzz editor Karen McGowan: Sorry!) for the banks.

Before Standard & Poor's killed stocks Monday with its downgrade of the United States, nobody in their right mind was saying that the economy or financial markets were in good shape.

The combination of chronically high unemployment and a terrible housing market may be bad news for banks. At the very least, it should lead to even less demand for loans. (What few the banks would approve in the first place.)

It also could cause problems for existing loan books. If the economy weakens further, would anyone be surprised if there was an increase in delinquencies for monthly mortgage, credit card or auto payments?

The Federal Reserve isn't helping either. While lower rates are usually a good thing for banks, that's not the case with rates near zero for over three years. It just makes it harder for the banks to squeeze out a profit from their lending operations.

"The domestic business for big banks is weak and may get weaker so we want to stay away from that. Extremely low interest rates are bad for the banks too," said Kent Gasaway, co-manager of the Buffalo Growth Fund (BUFGX) in Kansas City.

Gasaway's fund did own shares of JPMorgan Chase and Northern Trust (NTRS) as of the end of the first quarter. While he didn't say whether the fund still owns those stocks, he did say that he liked how both banks had strong international operations to help offset problems in the U.S.

In addition to concerns about the slowing economy, sovereign debt problems in Europe could also hurt large banks, according to Terry Morris, senior equity fund manager with National Penn Investors Trust Company in Wyomissing, Pa.

He added that regional banks may be hit by the knock-on credit downgrades of mortgage giants Fannie Mae and Freddie Mac as well as some municipal bonds. That's because many of those banks have exposure to the debt of Fannie and Freddie as well as munis.

Nonetheless, it does seem like some of the recent sell-offs are a bit overdone.

The pummeling of Bank of America also seems to be an unusual situation that shouldn't really hurt its rivals. BofA is facing numerous legal headaches tied to the foreclosure robo-signing scandal and bad mortgage investments it inherited when it bought Countrywide Financial.

Even though some big investors have agreed to settle with BofA over soured mortgage securities, there are lingering worries that BofA may need to raise capital to deal with the numerous lawsuits against it. The bank has repeatedly claimed that won't be the case.

Barkocy conceded that BofA is a "unique" case and that only investors who have years of patience should be looking at the stock now given the risks.

But he argues that other well-run large banks now could be good opportunities because they have been oversold. He cites Wells, U.S. Bancorp (USB, Fortune 500), Fifth Third (FITB, Fortune 500) and PNC (PNC, Fortune 500) as examples of banks that look attractive now.

Morris isn't so sure about that though. He said the only bank his firm owns in the large and mid-cap accounts he runs is Cullen/Frost Bankers (CFR), a San Antonio-based regional bank that turned down bailout money in 2008.

"There's no denying that many of the big banks are cheap. But cheap doesn't always equal value," said Morris. "If things keep deteriorating and the economy continues to slow down, there is a huge risk for banks," he said.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: