Search News

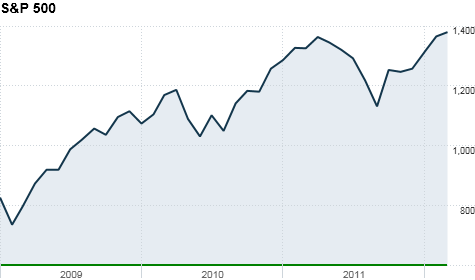

The S&P 500 has more than doubled in value since its March 2009 lows, and experts think the bull market rally has more room to run.

NEW YORK (CNNMoney) -- The bull market entered its fourth year this week, and while stocks have had an impressive run-up from the March 2009 lows, there's still room in this rally.

After hitting 12-year lows three years ago, stocks began to recover thanks to a stimulus-induced high, but experts say the advance is now being driven by solid fundamentals, especially strong earnings and low values.

Considering the stock market has logged an average yearly gain of just 7% for the past 65 years, "a 100% rally in three years is a big move," said Gary Thayer, chief macro strategist at Wells Fargo Advisors. "However, the stock market started the current bull market from a deeply depressed level and is not yet up to its pre-recession peak."

While the S&P 500 (SPX) is trading at its highest levels since June 2008, the broad index is still off about 14% from its all-time highs above 1,500 reached in October 2007.

Plus, the S&P 500's valuation is sill below average, noted Thayer. If valuations were above average and the market had delivered the same rally, the bull market might have been in jeopardy, he added.

While analysts aren't expecting the S&P 500 to reach new all-time highs anytime soon, the forecasts are still upbeat.

"This market's got legs," said Doug Cote, chief market strategist with ING Investment Management, whose year-end target for the S&P 500 is at 1,425. "We now have an effective fence built around Europe's debt crisis, and can focus on the underlying strength in fundamentals."

Cote said the biggest driver of stocks will be robust corporate earnings. In 2011, companies in the S&P 500 booked the best profits in history. While the pace of growth is expected to slow, Cote said earnings will continue to come in at record levels.

"How can you not be in the equity market when we're seeing all-time highs in corporate profits?" asked Cote. "We're advising our clients against waiting for a pullback because we don't think they've missed the big rally -- the market has a ways to go before it catches up with fundamentals."

In particular, Cote likes consumer discretionary stocks, because he thinks the labor market will continue to improve significantly, with the unemployment rate dropping below 8% this year, from 8.3% in February.

When consumers have a job, they're more likely to spend on expensive coffee, à la Starbucks (SBUX, Fortune 500), vacations at Walt Disney World (DIS, Fortune 500) or Wynn Resorts (WYNN), for example, or shopping for luxury items at Coach (COH) and Tiffany (TIF).

Not everyone is as bullish as Thayer or Cote.

Bill Strazzullo of Bell Curve Trading is advising his clients to get defensive.

"We made the same call last year in April when the market was at multi-year highs because the risk-reward picture didn't make sense," said Strazzullo. "We're back at those levels now."

While Strazzullo doesn't think the rally is over, he thinks it may be in the "last innings."

"We think it's time to start reducing exposure to equities rather than adding," he said.

Strazzullo is advising clients to shift into consumer staples, big pharmaceuticals and utility stocks -- so-called defensive stocks that typically offer stable earnings, dividends and returns even in uncertain times.

For example, while Strazzullo didn't name names, shares of Pfizer (PFE, Fortune 500) are near a 52-week high. And Merck (MRK, Fortune 500) offers a healthy 4.4% dividend.

"Over the last six months, things have gotten better, but there are still a lot of issues to work through," said Strazzullo. "The U.S. economy is still growing at just a modest pace even after the trillion in stimulus. And Europe is basically in a recession. The Middle East is a wildcard as well."

If the stock market does complete another year of the bull cycle, it will be beating the odds. During the 16 bull markets since 1932, only 7 have completed a fourth year, according to James Stack, a market historian and president of InvesTech Research. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: