Search News

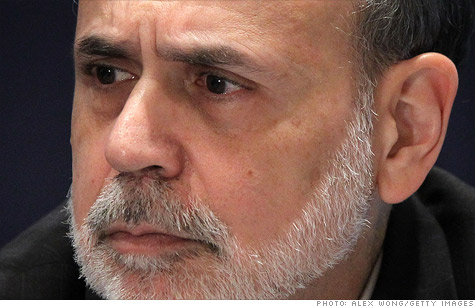

A weak jobs report may lead Federal Reserve chairman Ben Bernanke to reconsider whether more stimulus is needed for the economy. But the Fed should not pull the trigger on QE3 just yet.

NEW YORK (CNNMoney) -- There was nothing good about the Good Friday jobs report. But was the slowdown in hiring in March bad enough for the Federal Reserve to once again consider more stimulus for the economy?

No. It's important to look beyond the one disappointing month, and at the broader trend. Even though only 120,000 jobs were added in March, the average number of payroll gains for the first three months of the year (factoring in revisions for January and February) is about 212,000.

"The Fed is not going to be happy about the jobs report but it's not going to overreact to any one number either. There is a lot of volatility month to month in the jobs report," said Steve Blitz, senior economist for ITG Investment Research in New York.

The Fed's next policy meeting is a two-day session that concludes on April 25. That means there will be two-and-a-half more weeks of data about the overall economy (not just the labor market) for the Fed to digest before then.

And even if those numbers are universally weak, Fed chairman Ben Bernanke should still not be in a rush to announce plans for a third round of bond buying, or quantitative easing.

After all, the Fed is still purchasing long-term Treasuries through its Operation Twist program. Through Twist, the Fed is simply swapping short-term bonds for ones with longer maturity dates in order to not add more assets to the central bank's already-bloated balance sheet.

Twist does not expire until the end of June. The Fed has another two-day meeting that month. It concludes on June 20. So it would be reckless for the Fed to make any announcements about new stimulus plans until that meeting since it will be much closer to finishing its current round of bond buying.

Blitz said that the Fed has to hope that the economy can skate by for the next few months. But he added that it should not be a significant surprise to anyone (especially central bankers) that growth in the U.S. will be weaker during the second quarter. He said manufacturing may suffer due to the recession in Europe and concerns about a hard landing in China.

"The U.S. economy lately has been driven by manufacturing and industrial activity and a large part of that has been from selling to the rest of the world. This could be a difficult second quarter," he said. "But unless there is another crisis, the economy should eventually be okay."

Scott Brown, chief economist with Raymond James in St. Petersburg, Fla., added that the recent spike in gas prices may also hurt the economy in the second quarter. If consumers pull back on spending, employees could use that as an excuse to delay hiring more workers.

That said, Brown thinks gas prices would have to rise much further to put a big enough dent in the economy to justify more easing by the Fed.

"The impact of higher gas prices is not in full force yet. But QE3 is still not likely at this point," Brown said. "The recovery would have to falter more significantly."

Still, investors may clamor for QE3. The U.S. stock market was closed for regular trading Friday for the Good Friday holiday. But futures were open and they point to an ugly start Monday. The Dow futures fell more than 100 points.

Stocks dipped this week and one reason for that was comments in the minutes from the Fed's most recent meeting suggested that the central bank is not in favor of QE3. Of course, those minutes -- from the meeting in mid-March -- did not take into account the recent jobs slump.

The jobs numbers could help serve as a catalyst for a bigger pullback in stocks. And while some (including me) have argued that a correction is sorely needed, Bernanke may act sooner rather than later if stocks plunge too quickly.

"Bernanke is a student of the Depression so he may err on the side of being too aggressive. That has been the pattern," said Brad Sorensen, director of market and sector research for Charles Schwab in Denver.

The bond market, which was open for abbreviated trading Friday, seemed to be raising the odds for more Fed easing. Treasury prices surged following the jobs report, a potential sign that fixed-income investors expect the Fed to step up its bond purchases.

The yield on the benchmark 10-year Treasury fell to 2.05% late Friday morning from 2.18% before the jobs numbers came out. (Bond rates and prices move in opposite directions.)

Nonetheless, several experts expressed the hope that Bernanke does not cater to the whims of Wall Street.

While you could argue that QE, QE2 and Operation Twist helped boost the stock markets and that, in turn, led more companies to feel confident to hire more, it's debatable if more easing would help.

If anything, the Fed could be doing the economy a disservice by continuing to give investors an artificial excuse to buy stocks. More easing could weaken the dollar and create the risk of inflation.

"There is little the Fed can do for the job market. Pumping up the market further could be counterproductive," Blitz said.

It's not the Fed's job to make sure the Dow can stay above 13,000. And bond rates can't get much lower than where they are either without raising more concerns of Japan-style economic stagnation.

"We would not be advocates of QE3. A lack of liquidity is not a problem for the economy," Sorensen said.

Try telling that to traders though.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: