Search News

Click on chart for additional futures data.

Click on chart for additional futures data.

NEW YORK (CNNMoney.com) -- U.S. stocks were set to open higher Tuesday morning, following a global market rally and as investors set their sights on 2011.

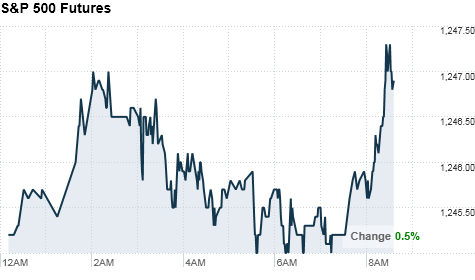

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up between 0.3% and 0.5% ahead of the opening bell. Futures measure current index values against perceived future performance.

On Monday, stocks ended mixed after waffling between gains and losses. The three major indexes have risen to two-year highs during the last few weeks, since President Obama announced the compromise deal on the Bush-era tax rates. Last Friday, the president signed a tax-cut plan into law.

Stocks rose about 5% this month, and are poised for double-digit gains for the year.

But the rest of the year is likely to be pretty quiet. "It goes back to a lack of volume. You have a lot of managers that are starting to go away the next couple of days for the holiday," said Michael Koskuba, senior portfolio manager at Victory Capital Management.

Overall, investors are feeling more optimistic of late. "Investors are looking a bit more favorably on equities. There is this mild bias up as we approach the end of the year," Koskuba said. "I think it definitely has to do with the economic data that has been coming out."

World markets: Korean peninsula tensions have eased slightly. North Korea initially threatened it would retaliate militarily following a South Korean live-fire naval drill exercise. However, North Korean military leaders instead issued a warning to South Korea and the United States.

Asian markets ended the session higher. The Shanghai Composite jumped 1.8%, the Hang Seng in Hong Kong rallied 1.6% and Japan's Nikkei gained 1.5%.

Also in Asia, the Bank of Japan held its key interest rate key interest rate unchanged between zero and 0.1%. And China's vice premier said China has supported the European Union with its debt crisis, also according to government-owned news agency Xinhua.

European stocks were also higher in afternoon trading. Britain's FTSE 100 gained 0.9%, the DAX in Germany also rose 0.9% and France's CAC 40 rallied 1%.

Eurozone debt woes continue to brew for overseas investors. Moody's Investors Service put Portugal's government bond ratings on review for a possible downgrade. Moody's cited "uncertainties about Portugal's longer-term economic vitality;" "concerns about Portugal's ability to access the capital markets at a sustainable price;" and concerns about whether how the government will be able to support the banking sector, "which may be needed for the banks to regain access to the private capital markets" as reasons for the downgrade watch, according to a statement from the company.

Companies: Toyota Motor Corp. (TM) -- the Japanese automaker that suffered a series of high-profile recalls -- will pay $32.4 million in civil penalties, the U.S. Department of Transportation said Monday. The penalty is the maximum allowed by law. Toyota's stock was little changed in premarket trade.

After the closing bell, Nike (NKE, Fortune 500) will report its quarterly results. Analysts expect the sporting giant to report earnings per share of 88 cents, up 12 cents from the same period last year.

After the closing bell on Monday, Adobe Systems (ADBE) reported a profit of $269 million, or 53 cents per share, compared with a loss of $32 million, or 6 cents per share, during the same period a year earlier. Shares of Adobe surged 5% in premarket trade.

Economy: There are no major economic reports on tap for Tuesday.

Currencies and commodities: The dollar fell against the euro and the Japanese yen, and gained slightly against the British pound.

Oil for February delivery added 43 cents to $89.80 a barrel.

Gold futures for February delivery added $5.30 to $1,391.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury ticked up, pushing the yield down to 3.31%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |