Search News

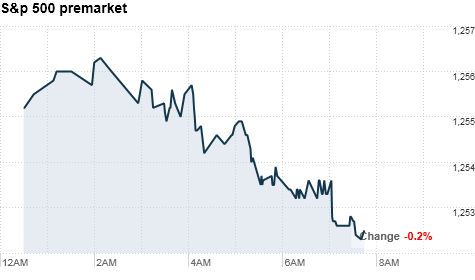

Click chart for more premarket data.

Click chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were poised for a lackluster trading session for the last day of 2010, but investors remained in good spirits as stocks served up solid annual gains amid the roller coaster year.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly lower ahead of the opening bell. Futures measure current index values against perceived future performance.

Though the market is open for a full trading day Friday, many investors have sealed their books and are celebrating another solid year for the stock market.

The Dow is up about 11%, the S&P 500 has climbed 13%, and the Nasdaq has soared 18% so far this year. But those gains didn't come without major hiccups.

Stocks had a strong start to 2010, but concerns about Europe's sovereign debt crisis weighed on the market. A slow economic recovery at home -- particularly in the U.S. job and housing markets -- also pressured stocks.

The May 6 "Flash Crash," when the Dow sank nearly 1,000 points in a matter of minutes, spooked investors and kept their stomachs churning for several months.

But in late August, Federal Reserve chairman Ben Bernanke assured investors that the central bank would do whatever it took to keep the economy from slipping back into a recession. That promise followed by the Fed's decision to pump $600 billion into the economy restored some confidence, and since then stocks have been on the rise.

Trading has been extremely thin during the year-end holiday season, and stocks aren't expected to make much of a move -- upward or downward -- on the last day.

On Thursday, stocks ended the trading session slightly in the red on light volume, despite better-than-expected reports on jobs, housing and manufacturing.

Companies: Shares of Borders Group (BGP) fell 18% in premarket trading after the bookseller said it taking steps to delay payments to vendors as it works to refinance its debt.

World markets: European stocks were lower in early trading. Britain's FTSE 100 and France's CAC 40 fell 0.7%. Germany's market was closed.

Asian markets ended mostly higher in thin trading. The Shanghai Composite gained 1.8%, and the Hang Seng in Hong Kong rose 0.2% during its half-day session. Japan was closed for a holiday.

Currencies and commodities: The dollar lost ground against the euro, the Japanese yen and the British pound.

Oil for February delivery slipped 14 cents to $89.70 a barrel.

Gold futures for February delivery rose $7.30 to $1,413.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose Friday, pushing the yield down to 3.35% from 3.37% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |