Search News

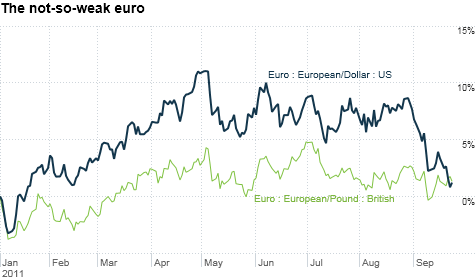

The euro has pulled back recently due to Greek default fears. But it has held its own against the U.S. dollar and British pound this year. Click chart for more on currencies.

NEW YORK (CNNMoney) -- The euro may be in intensive care right now. But even if Greece defaults, it's not time to start reading the currency its last rites just yet.

For all the talk about how bad the sovereign debt crisis in Europe is, you'd think that the euro would be completely tanking against most other currencies. But as the chart at the top of this page shows, it's not the case.

While the euro has weakened recently, it is still actually up slightly against the dollar and British pound this year. The euro may not be able to hold on to those gains much longer if Greece defaults, but it probably won't collapse either.

Experts said that the euro has a solid chance of making it through this crisis, albeit in a possibly modified (i.e. no Greece) form, simply because "strong" eurozone nations know that they are still better off with a unified currency for trade reasons.

Germany, France and The Netherlands, for example, could have a more difficult time exporting goods if they went back to the days of the Deutsche mark, franc and guilder.

A benefit of having a currency pegged to the economies of various nations is that the weaker ones balance out the healthier ones so you are left with a currency that shouldn't get too overheated. That's exactly the problem Switzerland is now facing with the Swiss franc.

"I think the members of the EU want the euro to survive. Whether or not Greece is part of the euro though, that's about a 50-50 proposition at this point," said Greg Michalowski, chief currency analyst with FXDD, a foreign exchange broker In New York.

Of course, the flip side to the unified currency argument is that it only takes problems in one member nation to spark a full-blown panic.

"For anyone skeptical of the euro, this is why. When you have a relatively small economy like Greece blow up it can affect everything," said Anthony Welch, co-manager of The Currency Strategies Fund (FOREX), a mutual fund specializing in foreign exchange investments in Sarasota, Fla. "If one state has a problem in the U.S., it may not impact the dollar and the other 49 states."

Welch said he's not expecting the euro to plummet but his fund is currently shorting the euro and going long the dollar.

Michalowski is also expecting more euro weakness. But he said a Greek default may mostly be priced into the euro. He thinks that if the euro does drop further, it may only be about 2% to around $1.32.

If anything, Michalowski said the biggest risk for the euro is that the European Central Bank may reverse course on its anti-inflation rhetoric and cut interest rates soon to try and stimulate Europe's sagging economy.

The ECB raised rates in July to 1.5%. And while that's still fairly low, it's higher than the virtually 0% rate in the U.S. and the 0.5% rate set by the Bank of England. A general rule of thumb in currencies is that the lower your rates are, the weaker your currency is.

"The ECB may look to lower their rates and that would be a big shift in policy," MIchalowski said. "That's one thing that would be a negative since higher rates have actually propped up the euro."

Brian Dolan, chief currency strategist with FOREX.com in Bedminster, N.J., agreed that the ECB is likely to cut rates. And because of that, he thinks the euro could fall as low as $1.28 in the near-term.

But he sees some light at the end of the tunnel. He thinks Greece will avoid a default. He said the so-called troika of the EU, ECB and IMF have to keep Greece afloat because a Greek default would inevitably lead to questions about whether it and fellow PIIGS Portugal, Ireland, Italy and Spain can remain in the euro.

"I am still of the view that Europe prevents a Greek default because of the unknown risks of what happens to the market. The EU doesn't want to have a Lehman moment," he said.

If Greece defaults, Dolan said all bets are off as to how far the euro falls. And it's that possibility that scares Welch. He's more skeptical than Dolan because he said it's difficult to know just what central banks can really do to save Greece.

"Does the euro continue? The euro is a flawed idea. Something has to be changed. If I knew exactly what that is I guess I'd be on the IMF," he quipped.

But there may be a way to solve the euro problem. Michael Woolfolk, senior currency strategist with Bank of New York Mellon in New York, said that Greece defaulting and Greece leaving the euro are two separate issues.

As such, Woolfolk said that the euro as a whole has a better chance to thrive if Greece readopted its own currency.

He argues that since the Greek economy is more dependent on tourism than exports, a devalued drachma would benefit Greece. And not having Greek debt woes dragging down the euro would lead to a stronger unified currency.

"It's a simple solution. It would be effective for Greece and it could help end some of the contagion fears," Woolfolk said.

Reader comments of the week. I was all prepared to give out just one award but there was a comment that came in late Friday that was too good to ignore. More on that in a sec.

First reader comment of the week goes to Christopher Craig. With the markets plummeting Wednesday and Thursday after the Fed's Operation Twist failed to impress, he tweeted this: "Please remind me next time that FED stands for Forces Everything Down."

That would have been the sole winner if not for Jeff Reeves. He followed up one of my tweets about the G20's Communique-ation Breakdown with an even better Led Zeppelin reference of his own.

"Hey fellas have ya heard the news Bennie's back in town? Won't take long just watch & see all the traders pull their money out."

That's just brilliant. Bernanke and the rest of the Fed definitely were a "Heartbreaker" this week.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: