Search News

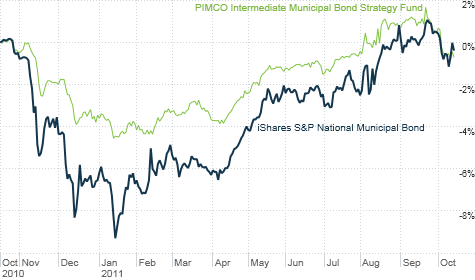

Muni bonds got hird hard earlier this year on worries about the economy. But even though many risks remain, investors have flocked back to the group.

NEW YORK (CNNMoney) -- Investors apparently have a finite capacity when it comes to panicking.

The market's still obsessed with Europe. (Slovakia says no! Slovakia says yes!) And there are growing concerns about the health of the big U.S. banks. But investors in municipal bonds are actually whistling a happy tune -- despite some troubling news.

Long-term diversified muni bond mutual funds are up more than 7% year-to-date, according to Morningstar.

And several leading muni bond exchange-traded funds, such as the iShares S&P National Municipal Bond Fund (MUB), PIMCO Intermediate Municipal Bond Strategy Fund (MUNI) and SPDR Nuveen Barclays Capital Muni Bond Fund (TFI), are only a shade below their 52-week highs.

It's a bit curious in light of some sobering developments in the world of munis recently. This week, Harrisburg, Pa., filed for bankruptcy. That news comes on the heels of the emergency bailout of Franco-Belgian bank Dexia, which is a guarantor of municipal bonds in the U.S.

What in the name of Meredith Whitney and Nouriel Roubini is going on here?

A couple of forces are at play. For one, muni bonds have become attractive again thanks to the Federal Reserve's latest pledge to keep interest rates low.

Even though the yield on the 10-year Treasury has moved up a bit since the Fed started buying long-term bonds with proceeds from sales of short-term debt, a program dubbed Operation Twist, a 2.2% yield for the 10-year is historically puny. By way of contrast, the MUB ETF sports a yield of 3.4%.

"The muni market is benefiting from Operation Twist. There is a sense that rates are going to be low a lot longer," said Alan McKnight, director of global investment strategy with Balentine, a money manager in Atlanta. "People are willing to take risks because they are so starved for yield."

Investors also may be hunting for bargains now that many of the doom and gloom predictions from Whitney and Roubini did not come to pass.

Several leading muni bond funds and ETFs fell more than 10% from the summer of 2010 through the beginning of this year. But not all states have problems as big as Illinois and Florida, for example.

"Earlier this year, some of the selling in munis was a little bit extreme," said Ronald Schwartz, managing director at StableRiver Capital Management in Orlando and manager of the RidgeWorth Investment Grade Tax-Exempt Bond Fund (STTBX). "Investors have realized that high quality municipal bonds are still very secure."

What's more, many state and local governments have proven to investors that they have been able to do what it takes to balance their budgets.

"After the initial panic, investors realized that municipalities had the political will to make tough decisions. Investor confidence has built through the year," said Regina Shafer a municipal bond portfolio manager with USAA Investment Management Company in San Antonio who runs the USAA Tax Exempt Intermediate Term (USATX) and USAA Tax Exempt Short-Term (USSTX) funds.

Even though the bankruptcy of Harrisburg is troubling -- it's normally not a good sign when a state capital is looking for protection against its debts -- the fiscal troubles in the Pennsylvania town were not a secret. The latest news is hardly a surprise, and may not be indicative of a broader trend.

"The market has been well aware with what's going on in Harrisburg for several years now," said Steven Shachat, manager of the Alpine Ultra Short Tax Optimized Income Fund (ATOIX) in Purchase, NY. "And it's an isolated incident. It has no direct relevance to Los Angeles, New York or anywhere else."

As for Dexia, its problems would have mattered a lot more a few years ago. The bank had already scaled back its presence in the U.S. muni bond market as a result of the 2008 financial crisis.

Nonetheless, investors have to be cautious. Schwartz said it's wise to stick with only AA and AAA rated muni bonds. In particular, he said bonds that finance essential services, such as water and electricity, as well university bonds, look the most stable.

McKnight agreed. But he worried that some investors are shying away from the highest-quality bonds in order to chase those that offer the fattest yields. Typically, those are the riskier bonds.

Shachat also pointed out that another reason munis have held up well lately is a simple case of the laws of supply and demand. Issuance is down from a year ago, so investors are scrambling to buy a more limited amount of available bonds.

And while it seems that some of the worst-case scenarios for munis were overblown, it's not as if state and local governments now face happier fiscal times ahead. Many states are going to have tough budget choices again as the weakening national economy should lead to lower tax revenues.

"Investors may be looking past credit issues and the fact that tax bases in many states are coming down," McKnight said. "Now is not the time to chase yield. It's time to be very judicious."

Reader comments of the week! The Buzz followers were on fire this week. Hard to choose just one top Tweeter. But since the most talked about topic this week was Research in Motion's BlackBerry outage, I figured I'd give a nod to RIM's convoluted co-CEO structure and give out co-comments of the week!

The first winner goes to Adam Van Ho for scoring points with a 1980s Europe (the continent, not the band) reference. "I'm starting to think #RIM should change the name of the #BlackBerry to the YugoBerry," he tweeted.

Well done, Adam. To continue the lemon theme, is the Playbook the Ford Pinto or AMC Gremlin of tablets?

Adam's partner in crime this week is Michele Clarke, aka @defcon_5. She summed the rise (and fall?) of BlackBerry's popularity pretty succinctly.

"The devices were ugly, the trackballs kept falling out, the screens were too small. But they worked. And now they don't."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: