Stocks rise on day, week

Wall Street manages gains at the end of an upbeat week, with the Dow topping 10,000. Unemployment spikes to a 26-year high. Oil prices slump as dollar churns.

NEW YORK�(CNNMoney.com) -- Stocks ended a volatile session higher Friday, on bets that the unemployment rate's spike to a 26-year high means the worst for the labor market has already happened.

Analyst upgrades of Dow component General Electric and Nasdaq heavy-hitter Amazon.com and sliding oil prices were also in the mix.

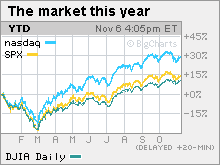

The Dow Jones industrial average (INDU) added 17 points, or 0.2%, closing at 10,023.43. The S&P 500 (SPX) gained 3 points or 0.3%, and the Nasdaq composite (COMP) rose 7 points, or 0.3%.

Stocks gained Thursday, with the Dow reclaiming 10,000 after a series of better-than-expected economic reports. But trading was very choppy Friday, with stocks slumping at the open and then seesawing for most of the session, before closing higher.

"The spike in the unemployment rate was a shock to the market," said Phil Orlando, chief equity market strategist at Federated Investors. "But once investors looked at it and digested it, they were able to take a more measured response."

He said while the unemployment rate jump was surprising, the number of non-farm payrolls cut -- combined with Thursday's weekly jobless claims report -- suggest the pace of layoffs is slowing.

All three major gauges finished higher for the week, recovering most of what was lost in a two-week selloff. Stocks, as represented by the broad S&P 500, had lost 5.6% through the end of last week as investors worried that the rally had gotten ahead of the recovery.

Prior to that selloff, the S&P 500 had rallied 63% off the March bottom.

Jobs: Employers cut 190,000 jobs from their payrolls in October, after cutting 219,000 in the previous month, according to a Labor Department report released Friday. That was worse than the 175,000 economists surveyed by Briefing.com.

The unemployment rate, generated by a separate survey, rose to a 26-year high of 10.2% from 9.8% in September. Economists thought the rate would rise to 9.9%.

Company news: Dow component General Electric (GE, Fortune 500) surged 6.2% after analysts at both Bernstein and Oppenheimer upgraded the stock to "outperform," according to reports.

Amazon.com (AMZN, Fortune 500) surged after Bernstein upgraded it to "outperform" from "market perform," and also lifted its 12-month target price on the stock, according to Briefing.com. AIG (AIG, Fortune 500), the insurance behemoth bailed out by the U.S. government, reported its second straight quarterly profit after seven quarters of losses.

Results were better than expected, but the company's main insurance businesses posted weaker revenue, sending shares tumbling by almost 10% Friday. AIG stock had rallied Thursday ahead of the results.

Starbucks (SBUX, Fortune 500) posted weaker quarterly results that beat expectations in a report released late Thursday. The coffee retailer also boosted its outlook for 2010 profit, after having cut costs and shuttered hundreds of stores in the last year. Shares gained 7.2%.

Fannie Mae (FNM, Fortune 500) reported an almost $19 billion quarterly loss on bad loans. The biggest U.S. mortgage lender also said it would need more help from the Treasury. Shares fell 7.1%.

Market breadth was mixed. On the New York Stock Exchange, winners topped losers by a narrow margin on volume of 1.08 billion shares. On the Nasdaq, decliners topped advancers seven to six on volume of 1.84 billion shares.

World markets: European markets were mixed. Asian markets rallied on the back of Wall Street's rally Thursday.

Currency and commodities: The dollar gained versus the euro and fell versus the yen.

U.S. light crude oil for December delivery fell $2.19 to settle at $77.43 a barrel on the New York Mercantile Exchange, a decline of more than 3%.

COMEX gold for December delivery climbed $6.40 to settle at $1,095.70 an ounce after hitting an all-time high of $1101.90 during the session.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.51% from 3.52% Thursday. Treasury prices and yields move in opposite directions. ![]()