Search News

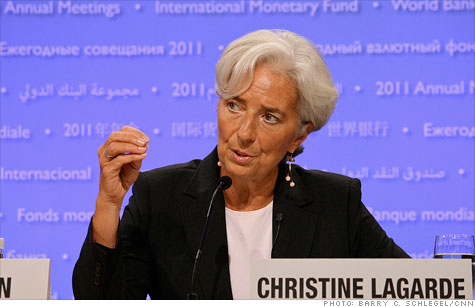

IMF director Christine Lagarde has called on eurozone leaders to 'do what is necessary' to resolve long-standing government debt and banking problems.

NEW YORK (CNNMoney) -- The International Monetary Fund lowered its outlook for the world economy on Tuesday, and warned that the global financial system faces growing risks from the debt crisis in Europe.

The IMF now expects the global economy to grow 3.3% in 2012, according to an update to its World Economic Outlook. In September, the IMF said the global economy would expand 4% this year.

Despite the weaker global outlook, the United States was the one country that didn't get its forecast lowered. The IMF said it still expects activity in the United States to expand 1.8% this year, unchanged from its previous forecast.

"The outlook for growth is mediocre, and it could be worse," said Olivier Blanchard, director of research at the IMF, in a pre-recorded interview.

The downward revision in global growth was driven primarily by the intensifying debt crisis in Europe, where the 17 nations of the eurozone are expected to suffer a mild recession this year, the IMF said.

The euro area economy is now expected to shrink 0.5% this year, down sharply from a projected growth rate of 1.1% in September.

The slowdown in the eurozone is "due to the rise in sovereign yields, the effects of bank deleveraging on the real economy, and the impact of additional fiscal consolidation announced by euro area governments," the IMF said.

Italy and Spain, two nations facing higher borrowing costs and difficult budget cuts, are expected to be in recession over the next two years. Germany and France, the largest economies in the eurozone, are both expected to grow less than 0.5% in 2012, before activity picks up in 2013.

Growth in emerging and developing markets overall is expected to grow 5.4% this year, down from the 6.2% rate the IMF had previosuly predicted. China, which has started to see its red hot economy cool, is expected to grow 8.2% this year, down from IMF's prior forecast of 9%.

Meanwhile, the global financial system faces increased risks from the debt crisis and banking problems in the eurozone, according to an update of the IMF's Global Financial Stability Report.

While the IMF welcomed recent steps eurozone political leaders have taken to contain the crisis, the report said more needs to be done to stabilize public finances and prevent a deeper credit freeze in the banking sector.

The IMF acknowledged that recent actions by the European Central Bank "likely forestalled an imminent crisis," and that borrowing costs for some troubled eurozone governments have eased in recent weeks.

But the report notes that longer-term interest rates remain high for many governments and that banks are still having trouble obtaining funding.

At the same time, the IMF stressed that governments should not cut back on spending too quickly, which could make the recession worse. And that bank "deleveraging" should not impact the flow of credit to businesses and consumers in the real economy.

"It is important that the euro area puts in place urgently a sufficient comprehensive strategy that leads to the full stabilization of sovereign debt markets and of the situation of banks," said José Viñals, director of the IMF's monetary and capital markets department. "This is absolutely fundamental."

On Monday, the fund's managing director, Christine Lagarde, backed a plan to combine an existing bailout fund with one that is in the process of being implemented in the eurozone. The combined funds could have resources worth €1 trillion, which the IMF says would help ensure markets that Italy and Spain are safe.

The IMF has also announced plans to increase its own resources by €500 billion, including a €200 billion commitment from euro area governments.

The 187-member fund, which provides emergency financial aid for troubled economies around the world, estimates that it will need €1 trillion to meet its commitments over the next few years. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: