Search News

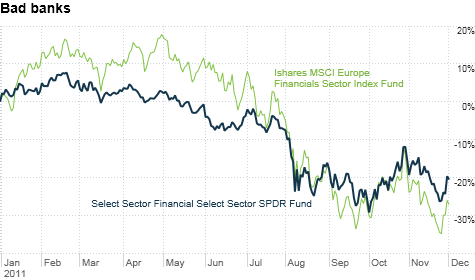

There have been several brief rallies for U.S. and European banks this year that have failed to last. The general trend is down.

NEW YORK (CNNMoney) -- That didn't last long.

Bank stocks were taking their lumps Thursday -- one day after surging along with the rest of the market thanks to the latest move from the Federal Reserve and other central banks to add liquidity to the global financial system.

JPMorgan Chase (JPM, Fortune 500) and Citigroup (C, Fortune 500) each fell more than 1%. Shares of Bank of America (BAC, Fortune 500), which popped 7% Wednesday, were down most of the day Thursday before getting a late boost.

And the U.S.-listed shares of several European banks -- including Barclays (BCS), UBS (UBS) and National Bank of Greece (NBG) -- all tumbled Thursday following sharp rallies a day earlier.

It just goes to show that the State of Euphoria (great Anthrax album, right @metalkaren?) for bank investors may already be over.

Now that reality has set in, investors have to ask themselves this Axl Rose-esque (keeping with the '80s rock theme) question: "Where do we go? Where do we go now? Where do we go? Oh oh oh."

I wrote two weeks ago that big bank stocks will be dead money for awhile. And nothing has happened to change that.

Sure, banks got a much needed jolt from the Fed and five other central banks. The Great Global Easing should help out big banks -- particularly troubled European lenders -- access short-term funding. That's necessary.

As we witnessed with Lehman Brothers in 2008, when everybody is petrified and goes into bunker mentality mode, the credit markets can freeze up quickly. That only makes financial crises even worse, turning them into true panics.

But central banks have not (and probably cannot) solve the nagging problem of ridiculously high sovereign debt loads in Europe.

Nor can the Fed erase the numerous issues plaguing BofA and other big U.S. banks -- worries about exposure to Europe, concerns about the stagnant U.S. economy and lawsuits tied to supbrime mortgage pools that went bad after the housing bubble burst as well as the foreclosure robo-signing scandal.

To that end, Massachusetts Attorney General Martha Coakley filed a lawsuit against BofA, Citi, JPMorgan Chase, Wells Fargo (WFC, Fortune 500) and privately held Ally Financial Thursday alleging mortgage fraud.

There was a reason that BofA almost dipped below the crucial $5 a share level a few days ago. And there is still a risk that it could edge back there -- no matter what the new owner of the Omaha World-Herald thinks of BofA's stock.

Bank stocks probably would have fallen Wednesday if not for the Fed's action. Most bank stocks were down after hours Tuesday following a downgrade of a bevy of banks by Standard & Poor's. It cut ratings on BofA, Citi, JPMorgan, Wells, Goldman Stanley (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) among others.

With all that in mind. several value fund managers said they are still wary of the big banks because there are simply too many wild cards.

"The problem with the bank stocks is you still don't know what they have and own. They are still not transparent enough," said Craig Hodges, co-manager of the Hodges Pure Contrarian Fund (HDPCX) in Dallas. "So many things can go wrong and you are kind of flying blind."

Hodges conceded that many bank stocks are trading at extremely low valuations and thinks the stocks may very well be higher five years from now. But he added that they will likely remain incredibly volatile for the next year and a half. In other words, you can hold off for a while before considering an investment.

Just look at the chart at the top of the page. It shows the performance of two key bank ETFs, the Financial Select SPDR (XLF) for U.S. banks and the iShares MSCI Europe Financials Index (EUFN) for European banks.

Bank stocks have enjoyed several big pops throughout 2011. But they have been fleeting. The general trend is down. It shows that just because something is cheap, it may not be a good bargain.

Wendell Perkins, portfolio manager with Manulife Asset Management in Milwaukee, agreed. He said there are better opportunities in the financial sector than the Wall Street giants.

"At this point in time we'd prefer to buy better regional banks than diversified global banks," he said. "The bigger banks face the worst aspects of regulatory challenges. And the capital markets are mired in muck." He named PNC (PNC, Fortune 500) and BB&T (BBT, Fortune 500) are two favorites among the regional banks.

Perkins, who also co-manages the John Hancock International Value Equity Fund (JIEEX) for Manulife, said that he's starting to shy away from European banks as well.

"We have exposure to some European banks but we've reduced it a lot. We are losing any confidence that there will be a positive outcome in a timely manner to the euro crisis," he said.

Join the club.

Best of StockTwits: It's the first of December. 'Tis the season to talk about retailers! Yoga apparel maker and momentum darling Lululemon tanked on a "disappointing" earnings report. Strong Nook sales were not enough to boost Barnes and Noble. And other retailers rallied after announcing November sales.

fundmyfund: I would not say $LULU is having trouble growing sales, they were >30% yoy, and 16% SSS. It's just vs very high expectations.

charlesrotblut: Saw the$LULU headlines. As someone who practices yoga, I can assure you that $100 yoga pants are not necessary for doing downward dog.

So true. I say "namaste" to any patient LULU longs. Numbers were great and it's a solid company. But retail is fickle. This is a lesson to investors chasing highflying fad stocks with lofty valuations. They almost always stumble at some point.

oktobernv: Everytime I see a "nook" commercial.....I smile and feel grateful that I am short the stock. $BKS

Anyone who thought the demise of Borders was good news for Barnes and Noble obviously forgot there's a little company called Amazon killing BKS.

Retail_Guru: Target misses target, Saks, Macys beat Nov sales forecasts. Winners keep winning, some surprising losers? $TGT $M $SKS $LTD

Not sure what's going on with Target. But if the stock keeps sliding, they may need some more Missoni stuff to run out of. Stat!

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: