Search News

It has hardly been a fantastic year for the U.S. market. But the S&P 500 has been a stud compared to stocks in China. And Europe. And Japan. And Brazil. The list goes on.

NEW YORK (CNNMoney) -- Baseball manager Casey Stengel once famously asked, "Can't anybody here play this game?"

Stengel was referring to the hapless New York Mets during their inaugural season in 1962. But he might as well have been discussing the global stock market in 2011.

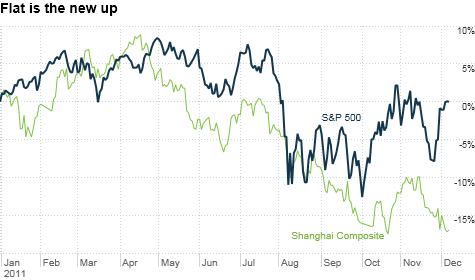

Take a look at how the world's major markets have done this year and one word immediately comes to mind. Sad. The S&P 500 is essentially flat (down less than 1%) in 2011. And that's the best performer in a sorry bunch.

Europe? Britain's FTSE is down nearly 6% while France's CAC and Germany's DAX have each plunged about 15%. I hear there may be a debt crisis thingamajig or something going on there?

Asia? Japan is still reeling from the effects of March's earthquake and tsunami. The Nikkei is down 15%. China, despite a robust economy, has taken its lumps due to fears about asset bubbles and that Europe's woes will slow down China's growth. The Shanghai Composite has plummeted 17% in 2011.

It's the same story in other emerging markets. India's Mumbai Sensex is down 18%. Brazil's Bovespa has dropped 15%.

Even other developed markets outside of Europe have not been immune to the global sell-off: Canada's S&P/TSX 60 and Australia's ASX All Ordinaries indexes are both nursing double-digit percentage losses.

Looking ahead to 2012, investors may need to brace for more of the same. Europe is not going to get solved overnight -- even if there is progress at the big EU meeting on Friday.

"Everyone is hoping that there will be a fix in Europe. But there is still a high probability of a breakup of the EU. And emerging markets will get caught up in that," said Stephen Hammers, manager of the Compass EMP Alternative Strategies Fund (CAITX) in Brentwood, Tenn.

And the bickering in Congress this year that helped lead to a credit rating downgrade is only likely to get worse in 2012. After all, getting elected or re-elected will probably take precedence over governing.

"The U.S. is the best house in a bad neighborhood. A lot of it has to do with policy decisions and politics around the world and that's very discomforting," said James Dailey, manager of the TEAM Asset Strategy Fund (TEAMX) in Harrisburg, Pa. "That's led to a lot of paralysis. Investors are walking away from stocks and raising cash."

That said, the good news for the U.S. is that many blue chip American stocks remain cheap. I focused on two -- Google (GOOG, Fortune 500) and McDonald's (MCD, Fortune 500) -- in my most recent columns. There are plenty of large multinational firms with lots of cash and little debt. The same isn't true in many markets overseas.

So even though few expect the U.S. economy to be vibrant next year, that may be enough to make American stocks attractive.

"It is a less than favorable environment for the U.S. economy, but U.S. stocks should continue to outperform. Valuations are low," said Dan Morris, manager of the Manor Growth Fund (MNRGX) in Malvern, Pa. "Valuations got out of whack in emerging markets, but it still may not be a buying opportunity yet even after the pullback."

Another negative for emerging markets? Despite robust economies, a lot of the strength in the so-called BRIC nations of Brazil, Russia, India and China is tied to selling goods to the U.S. and Europe.

"Emerging markets, especially the ones that are dependent on exports, will be hit by a global downturn in trade," said Frances Hudson, global thematic strategist with Standard Life Investments in Edinburgh, Scotland.

Still, some think that the sell-off in developing markets is overdone. And that may make them prime candidates to bounce back next year.

"Whether you like it or not, emerging markets are going to be the only places in the world where you will get growth," said Paul Dietrich, CEO of Foxhall Capital Management, in Orange, Conn. "China's economy may have slowed from a double-digit rate to about 9%, but that's still spectacular."

In addition, emerging markets are finally joining what I've dubbed the Great Global Easing. Brazil and China now recognize the global economy is slowing. So they are doing more to combat that instead of fighting domestic inflation with rate hikes.

John Toohey, vice president of equity investments with USAA Investment Management in San Antonio, said more rate cuts, or in the case of China, lower reserve requirements for banks, could boost stock prices in emerging markets.

But as long as developed market debt woes and recession fears remain in the headlines, Dailey said the best investing bets for 2012 are currencies and commodities that can benefit if the Federal Reserve and ECB continue to engage in easy money policies.

While rate cuts and various liquidity programs may prevent a credit crunch, they are essentially programs designed to print money. And that eventually could lead to inflation

Dailey likes the Mexican peso vs. the dollar, gold and gold miners and fertilizer companies, which could get a boost from rising food prices. But he cautioned that they, like just about everything else in markets around the world, are likely to get violently whipsawed.

"Short-term market moves will continue to drive people crazy in 2012," he said. "If people are looking for something that will be safe and not volatile, that investment doesn't exist right now."

Best of StockTwits: Investors are not happy about the extraordinary moves the Fed is taking to help the big banks. The Oracle of Omaha gets some sunlight. And it's finally a good thing for a company bearing the name of a certain "domestic doyenne."

ScottB4u: The nation's wealth is being flushed down the toilet to save banks. No energy plan no jobs plan no infrastructure plan. Just a Market plan.

It is unfortunate that the Fed is probably the most decisive body in Washington -- and that much of their actions are meant to help Wall Street more than Main Street. Maybe preserving bonuses should be the third mandate?

aztecs99: $FSLR selling Topaz to Berkshire's MA Energy Holdings - early pop on FSLR - a positive surprise for them.

This is good news for First Solar (FSLR). But Warren Buffett's Berkshire Hathaway (BRKB) will need to buy a lot more plants to make a difference for the struggling company. The stock is still down more than 60% year-to-date.

agwarner: $MSO forming a swan-napkin breakout here.

Ha! But is it a Black Swan?

ReformedBroker: JCPenney taking a stake in Martha Stewart, together they'll be known as Mommasaurus Rex $JCP $MSO

Josh Brown for the win! Although Mommasaurus Rex is a great name for the JCP (JCP, Fortune 500)-MSO (MSO) alliance. But it sounds suspiciously like one of those fake bands you always claim are playing The Bowery Ballroom or Terminal 5. Are they opening up for Mario and the Merkelettes Friday night?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: