Search News

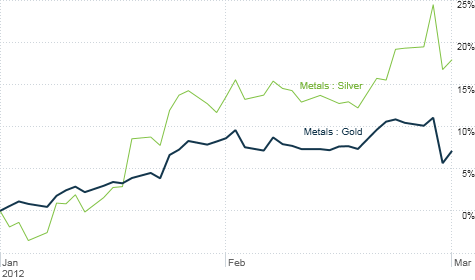

Gold and silver plunged Wednesday during Ben Bernanke's congressional testimony. But they bounced back Thursday and are stll up sharply year-to-date. Click chart for more on commodities.

NEW YORK (CNNMoney) -- Just call it the gold cold.

The yellow metal plunged 4% Wednesday after investors interpreted comments from Federal Reserve chairman Ben Bernanke at his semi-annual hearing before the House as a sign that the Fed would not be launching a third round of quantitative easing, or QE3.

Silver and other precious metals were crushed too. Generally, investors view more quantitative easing by the Fed, i.e. the purchase of long-term bonds in order to keep rates low, as bullish for commodities.

That's because QE and its offspring QE2 and Operation Twist -- swapping short-term bonds for long-term ones -- essentially amount to the Fed printing money. That reduces the value of the dollar, boosts the price of assets traded in it (like oil) and raises inflation fears. All that is music to the ears of a gold bug.

So the lack of any strong QE3 hints from Bernanke must be terrible news for gold, right? Wrong. Like many common viruses, the gold cold looks like it may merely be one of the 24-hour variety.

Gold and other commodities bounced back Thursday. And several investing experts think that Wednesday's sell-off is likely a short-term blip.

"A rogue wave of risk aversion roiled the precious metals markets Wednesday. It was an extraordinary move for gold and silver, a textbook pullback," said Richard Ross, global technical strategist with Auerbach Grayson, a brokerage firm in New York "But gold still looks strong."

Ross noted that if investors were really nervous about Bernanke's comments, gold would have continued plunging Thursday -- especially since Bernanke didn't give any further QE3 clues during his Senate hearing.

In fact, the drop in gold Wednesday shouldn't be that big of a surprise since gold prices had run up more than 10% so far this year before Bernanke's testimony.

"What the rebound on Thursday shows you is that investors used the dip as an excuse to get back in to gold. The move didn't seem to do any psychological damage," Ross said.

Madeline Schnapp, director of macroeconomic research for TrimTabs, a research firm based in Sausalito, Calif., agreed. She called Wednesday's metal meltdown an "overreaction."

Schnapp said that even though Bernanke didn't explicitly endorse the idea of QE3, the market still is anticipating some form of additional Fed stimulus later this year. After all, Operation Twist ends in June.

Plus, Bernanke didn't talk about the economy being in great shape. That's why the Fed has pledged to keep a key short-term rate near zero until the end of 2014. All signs still appear to point to the Fed remaining in an easing mode for a long time. That's good for gold.

"The market loves liquidity. It feeds on it. If there are any hints the punchbowl will be removed, that will be bad," Schnapp said. "But the market is expecting some further forms of easing and the gold market is anticipating an ongoing decline in the dollar."

Jeff Sica, president and chief investment officer of SICA Wealth Management in Morristown, N.J., said that he thinks Bernanke is in a bind. Just because Bernanke didn't send QE3 smoke signals doesn't mean that there still won't eventually be more easing.

The Fed chairman likely needs to talk down the possibility of QE3 because he doesn't want already high commodity prices to shoot even higher.

"The moment you mention printing money, commodity prices shoot up. So Bernanke will wait until things get ugly again before talking more about QE3," Sica said.

However, Sica is convinced that Bernanke is ready to pull the QE3 trigger later this year -- especially if economic growth and the recent recovery in the job market begin to cool again.

That's why he said he bought more precious metals Wednesday even as prices were falling. He purchased the ETFS Physical Swiss Gold Shares (SGOL), ETFS Physical Silver Shares (SIVR), ETFS Physical Palladium Shares (PALL) and ETFS Physical Platinum Shares (PPLT) exchange traded funds.

"Bernanke has only one card up his sleeve. If high oil prices undermine the economic recovery, he will play that card -- despite the fact that more quantitative easing could lead to even higher commodity prices," Sica said.

Best of StockTwits: People are buying clothes .. and cars. Strong results from several retailers as well as Ford (F, Fortune 500) were helping to lift the market Thursday.

SheilaD_TV: Apparently everyone went shopping in February. $GPS, $TGT, $JWN, $SKS all beat estimates #shoptilyoudrop

OptionsHawk: The Gap $GPS trading at 10 year highs, pretty crazy for how hated it was just a few months ago.

stephanie_link: $TJX sss up 9% - ahead of 7% expectation. Overall strong results so far $TGT $GPS $M. Easy compares of course, but people spending.

It is often said that you shouldn't underestimate the resilience of the U.S. consumer. The same-store sales reports from retailers up and down the value chain are encouraging.

When discount chains like Target (TGT, Fortune 500) are doing well and higher-end retailers like Saks (SKS) and Nordstrom (JWN, Fortune 500) also top forecasts, it shows that the strength in spending is fairly broad. And the rebound at The Gap (GPS, Fortune 500) is nothing short of miraculous. This was a $10 stock three years ago and it's back up near $25 now.

ToddSullivan: $F upping production in Q2 3% to 730K due to increased demand for its vehicles

ToddSullivan: You know$F is on a roll when even Lincoln sales are up 16%

The comeback in Detroit -- GM (GM, Fortune 500) sales topped forecasts too and Chrysler's sales surged 40% from last year -- is great to see. I still am a little worried though about rising gas prices. That could put a dent in auto sales ... and auto stocks.. later this year.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: