The hotel chain, meanwhile, showed assets of only $7.1 billion at the end of 2008 with sales of $1 billion for the year. And revenues tumbled further as the recession dug in deeper: The first five months of 2009 saw revenue per available room crater by 23.2% compared to the same period the year prior.

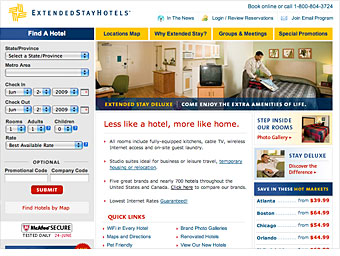

The hotel chain is popular among business travelers who have to work away from home for more than a night, offering apartment-like conditions with fully equipped kitchen, expanded work space, wireless Internet, onsite guest laundry facilities, and pet-friendly rooms.

During the bankruptcy process, the hotel chain -- which has more than 680 properties under a handful of regional names such as Extended Stay America, Homestead Studio Suites, Studio PLUS and Crossland -- will all remain open and in operation.

NEXT: Crunch Gym feels the burn