Click the chart for more premarket data.

Click the chart for more premarket data.

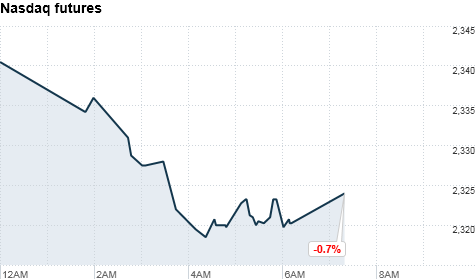

NEW YORK�(CNNMoney) -- U.S. stocks are gearing up for losses at the opening bell Tuesday, as investors mull over the rebalancing of the Nasdaq-100 index to diminish Apple's influence, a rate hike in China and another downgrade of Portugal's debt.

Nasdaq Composite (COMP) futures fell 19 points, or 0.8%, ahead of the opening bell Tuesday. Dow Jones industrial average (INDU) and S&P 500 (SPX) futures were down about 0.3%. Futures measure current index values against perceived future performance.

Nasdaq OMX Group announced Tuesday it will rebalance its tech-heavy Nasdaq-100 index, reducing Apple's (AAPL, Fortune 500) weight by almost 40% -- to 12.3% from 20.5%. The change takes effect on May 2.

The change will lend more weight to Google (GOOG, Fortune 500), Intel (INTC, Fortune 500), Microsoft (MSFT, Fortune 500) and Oracle (ORCL, Fortune 500).

Apple shares fell nearly 3% in premarket trading. Microsoft, Intel and Oracle each nudged about 1% higher.

"Those investors who've got a portfolio tracking that index will need to sell Apple shares to rebalance their portfolio," said James Cordwell, digital equity analyst with Atlantic Equities in London. "Investors would have to shift from Apple to Oracle and Microsoft."

The Nasdaq-100 (NDX) includes the 100 largest nonfinancial companies listed on the Nasdaq exchange -- not to be confused with the Nasdaq Composite, which includes all of the roughly 3,000 companies listed on the exchange.

Meanwhile, Europe's debt crisis is back in focus, after Moody's Investors Service downgraded Portugal's debt to a lower investment grade rating.

Among various reasons for the change, the ratings agency cited Portugal's "uncertain political outlook," following Jose Socrates' resignation as the country's prime minister two weeks ago.

The People's Bank of China also surprised investors Tuesday by announcing a quarter percentage point hike in interest rates, as part of its continued efforts to gradually slow down the country's rapidly rising prices.

China's benchmark one-year lending rate now stands at 6.31%.

"The announcement may cause jitters about the impact tightening will have on Chinese growth. However these should not be overplayed," Mark Williams, senior China economist with Capital Economics, said in a research note. "The latest increases... are in line with the gradual policy tightening that has been underway over the last few months and will not do much to slow the economy."

Stocks closed little changed Monday, as investors took a wait-and-see approach about the economy.

World markets: European stocks fell in midday trading. Both Britain's FTSE 100 and the DAX in Germany fell 0.3%, while France's CAC 40 lost 0.6%.

Japan's Nikkei ended 1% lower. Markets in Shanghai and Hong Kong were both closed for a holiday.

Economy: At 10 a.m. ET, the Institute for Supply Management will release its monthly gauge on the service-sector index for March. Economists are looking for the index to slip slightly to 59.5, compared with last month's reading of 59.7, a level that would still indicate expansion in the sector.

Later in the day, the Federal Reserve will release minutes from its March 15 policy meeting.

Companies: KB Home (KBH) shares fell nearly 6% after the homebuilder announced a quarterly loss of $114.5 million, or $1.49 a share. That's far deeper than the loss analysts were expecting.

Shares of rival homebuilder Lennar Corp. (LEN) fell 0.5% in early trading after the announcement.

Shares of National Semiconductor (NSM) surged 71% in premarket trading. Late Monday, the company agreed to be acquired by Texas Instruments (TXN, Fortune 500) for $6.5 billion in cash. Shares of Texas Instruments fell 2.4%.

Shares of Expedia (EXPE) rose almost 5% in early trading, after American Airlines announced the two companies will resume doing business together after reaching an agreement on airfare sales.

Diamond Foods, Inc (DMND) and Procter & Gamble Company (PG, Fortune 500) announced plans to merge PG's Pringles chips business under Diamond Foods. Shares of Diamond Foods surged 7.5%, after the $2.35 billion deal was announced.

Currencies and commodities: The dollar rose against the euro and the Japanese yen, but fell against the British pound.

Crude oil for May delivery slipped 54 cents to $107.93 a barrel.

Gold futures for June delivery rose 70 cents to $1,433.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.42% from 3.43% late Monday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |