Search News

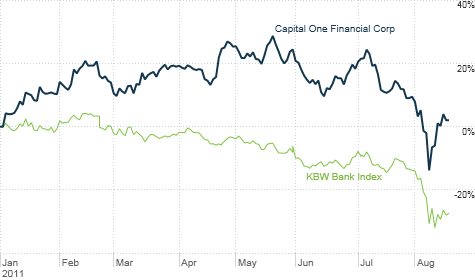

Capital One's stock has taken a hit this summer along with the rest of the banking sector. But it's still up in 2011 -- making it the only major U.S. bank in positive territory.

NEW YORK (CNNMoney) -- Give those credit card-loving Vikings a raise!

Capital One (COF, Fortune 500), the bank well-known for an ad campaign featuring a financially savvy group of marauders (not to mention Alec Baldwin), has emerged from the great bank stock sell-off of 2011 unscathed.

Shares of Capital One are up about 5% year-to-date, a truly impressive feat when you consider that the KBW Bank Index (BKX) has plunged 25% this year. In fact, Capital One is the only one of the two dozen banks in this index that is up in 2011.

Other large banks, most notably Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500), have fared even worse than the broader bank index. Citi's stock has plummeted 35% while BofA has taken a nearly 45% haircut. BofA's drop is largely due to lingering worries about bad mortgages.

So why has Capital One done so well? It may not be as exposed to the economic and financial market tumult as BofA and the other megabanks. But it's no slouch.

Capital One was big enough to need more than $3.5 billion in bailout funds during the 2008 meltdown. It was also one of the 19 banks subjected to stress tests in 2009.

One word: Plastic. (Note to fans of "The Graduate" -- I realize the famous quote is actually "Plastics.") Capital One has benefited from the fact that it is a credit card lender first and full-blown diversified bank second.

While BofA, Citi and other rivals like JPMorgan Chase (JPM, Fortune 500) and Wells Fargo (WFC, Fortune 500) have been hit hard by concerns about the continued problems in the housing market and the debt crisis in Europe, Capital One still generates a majority of its loans from good old-fashioned credit cards.

And even though the sorry state of the U.S. economy is clearly something that any bank investor has to worry about, high levels of unemployment have not translated into problems for credit card portfolios. It's actually been the opposite.

The combination of consumers acting more financially responsible (Washington, you should take notes) and banks tightening their lending standards has led to a notable decline in credit card late payments and bad loans.

Capital One's delinquency rate for its credit card portfolio was just 3.6% of balances in the second quarter, down from 4.9% a year ago. And the rate of net charge-offs (i.e. loans written off as bad) was only 5.1% in the second quarter, compared to 9.4% in the same period last year.

That trend -- improving quality in credit card portfolios -- is actually taking place throughout much of the banking industry. That's a big reason why other companies that have big credit card exposure, such as American Express (AXP, Fortune 500) and Discover Financial Services (DFS, Fortune 500), have also avoided the big bank bear.

"Capital One gets lumped in with credit card companies as opposed to the traditional banks," said Michael Taiano, an analyst with Sandler O'Neill & Partners in New York.

"I like Capital One's position compared to the more diversified banks because it is less reliant on commercial real estate and residential mortgages," Taiano added.

Still, its not as if Capital One has been immune from the recent market turmoil. Shares are down more than 20% from their 52-week high set in May. Part of that could be due to concerns that credit trends will reverse if the economy gets worse.

But there may also be some fears that Capital One is embarking on a bold acquisition strategy that could create some merger integration headaches.

Capital One announced in June that it was buying the ING Direct U.S. online banking unit from Dutch financial services giant ING (ING) for $9 billion.

ING Direct is a fairly beloved brand (Disclosure: I have an account with it and its brokerage unit ShareBuilder) due to its low fees and great customer service. There are concerns about what may happen under new ownership. Capital One has stressed, however, that it is not planning any significant changes.

But that's not the only big purchase for Capital One. Just last week, it also agreed to shell out $2.6 billion for the U.S. credit card portfolio of HSBC (HBC), the big British bank that is doing its best impersonation of Lord Cornwallis and surrendering much of its American assets.

Taiano conceded that doing two significant deals simultaneously could be a problem, but he thinks Capital One will pull it off and that the purchases will add to earnings.

Tom Villalta, manager of the Jones Villalta Opportunity Fund (JVOFX) in Austin, said Capital One should be rewarded, not punished, for its recent moves. His fund owns shares of Capital One.

"Many banks need to shrink and shore up their capital base. But Capital One doesn't have that problem," he said. "No other large bank has made such an aggressive move in positioning itself for growth following the credit crisis."

Of course, investors need to be somewhat wary of Capital One. It still is a financial stock after all.

The credit card business looks good now. But remember that there was a time only a few years ago when many people downplayed the first signs of mortgage problems. They would be "contained."

Bank of America is Exhibit A for how that all worked out.

This is not to say that a credit card disaster is looming. But the very thing that investors are cheering Capital One for now could turn out to be a huge negative if the economy makes a notable turn for the worse.

And short sellers in bank stocks have a much worse reputation than Vikings when it comes to pillaging.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: