Search News

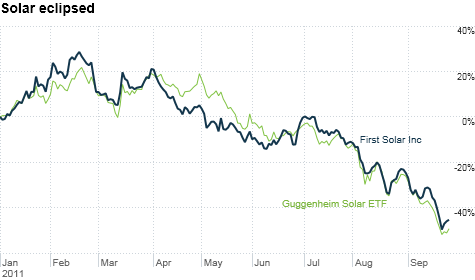

First Solar and other solar stocks surged after the Japan earthquake amid nuclear meltdown fears. But they've plunged following the Solyndra bankruptcy. Europe's debt crisis isn't helping.

NEW YORK (CNNMoney) -- To say that the bankruptcy of government-backed solar energy firm Solyndra is a blow to the industry is a massive understatement.

Consider this. Shares of First Solar (FSLR), a leading solar firm that's actually big enough to be in the S&P 500 (SPX) and Nasdaq 100 (NDX), are down about 25% since Solyndra went under on August 31. And that makes First Solar one of the better performing stocks in the sector.

The Guggenheim Solar (TAN) exchange-traded fund, which has the "ain't we so precious" ticker symbol of TAN, has plunged nearly 34%. Several Chinese solar stocks, including Jinko Solar (JKS) and Trina Solar (TSL), have lost more than half their value.

The collapse of Solyndra highlights just how risky this still-nascent business is. It didn't help either that Solyndra filed for Chapter 11 just two weeks after another publicly traded solar firm, Evergreen Solar (ESLRQ), did the same.

So are all solar stocks getting unfairly burned (Boo! Hiss! I know.) because of the sins of Solyndra and Evergreen? No.

Even before the bankruptcies of Solyndra and Evergreen, shares of solar leaders had pulled back sharply from earlier highs this spring.

You may recall that back in March, solar stocks were, well, hotter than the sun, due to investor expectations that the Japan earthquake and resulting nuclear crisis would lead to more demand for safer and cleaner solar energy in Europe and the United States.

But those hopes have been dashed by the sovereign debt nightmare in Europe and the budget battle in the U.S.

Spain and Italy have pledged to reduce lucrative subsidies to solar companies.

And the fact that Solyndra, a firm that received more than $500 million from the Department of Energy, went kaput could make it much more difficult for other solar companies to get funding going forward. "Solar" is now as dirty a word in Congress as "stimulus" or "taxes."

With all that in mind, it may still be wise to avoid solar companies -- even if they appear attractive. Sure, First Solar now trades at less than 8 times earnings estimates.

But Aaron Chew, an analyst with Maxim Group in New York, said solar companies may be the classic value trap. They only seem cheap because earnings estimates are too high.

Chew thinks that most solar companies will continue to face pressure because of overly optimistic expectations for solar panel demand earlier this year. It's a simple case of Economics 101. A glut of photovoltaic panels + less demand from cash-strapped developed markets = solar meltdown.

"The stock declines for solar companies really have nothing to do with Solyndra. They'd be here even without that," he said. "Solyndra gets a lot of attention for symbolic reasons. But what's happening is you have oversupply and plunging prices and that's just being exacerbated by Europe."

Another analyst points out that as long as other forms of energy are affordable for businesses and consumers, it may be difficult for solar firms to gain ground.

"Natural gas is at about $4 [per million BTUs] and it's relatively clean," said William Burns, an analyst with Johnson Rice, an energy boutique research firm in New Orleans. "To try and be competitive with that will make it tough for solar energy. It might be different if natural gas was $8 or $9."

It will be worth keeping an eye on the industry though. If the stocks fall much further, some solar companies could become takeover targets.

French energy giant Total (TOT) is buying American solar firm SunPower (SPWRA). Chew noted that First Solar is similar to SunPower in that it has two major sources of revenue. It makes solar panels but also installs solar projects. That diversification could make it more attractive than the pure play panel companies.

Chew said there has been recent chatter that General Electric (GE, Fortune 500) could be interested in First Solar. Last year, there was speculation that German industrial conglomerate Siemens (SI) could be a buyer.

Alex Morris, an analyst with Raymond James in Houston, said he doesn't rule those rumors out completely. But he said investors shouldn't bet on mergers either. The industry is still in for tough times ahead.

"I'd be very hesitant with these stocks. People got caught off guard with how quickly prices fell and the effect that's had on profit margins," Morris said. "I'm looking for mild improvement in the coming quarter but it's gong to be ugly."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: