Search News

The debt crisis in Europe is not over. And multinational firms in the U.S. with euro exposure like cereal maker Kellogg are starting to suffer as a result.

NEW YORK (CNNMoney) -- Referring to the European debt crisis with the cutesy shorthand acronym of the PIIGS just doesn't seem right anymore.

The problems on the continent now go far beyond the southern peripheral nations of Portugal, Italy, Greece and Spain (with Ireland up north tossed in for good measure.)

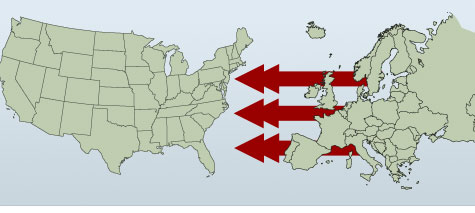

Political instability in France and The Netherlands are making investors even more nervous. And they should be -- especially since Europe's woes are starting to spill across the Atlantic.

Several U.S. firms that reported their latest quarterly results Monday morning specifically cited weakness in Europe as a major problem.

Cereal company Kellogg (K, Fortune 500) lowered its 2012 earnings and sales forecasts Monday morning. In a statement, CEO John Bryant said the company faced "significant challenges" in Europe.

Wolverine World Wide (WWW), which sells shoes under the Hush Puppies and Merrell brands, said in its earnings report Monday that its sales outlook for the current year is "tempered by macroeconomic and financial uncertainty in Europe," adding that the environment on the continent is "recessionary."

Cleaning-equipment maker Tennant (TNC) reported first quarter profits and sales that missed forecasts and had perhaps the most dire assessment of the situation in Europe. The company said one reason for soft sales growth was because "the European debt crisis made it more difficult for Tennant customers to obtain credit."

That comment should send shivers down the spines of all U.S. multinationals with a big presence in Europe -- not to mention investors.

It's bad enough that many average consumers in Europe may be cutting back on spending. But if corporate customers are also being forced to pull back because banks aren't lending, that's highly disconcerting.

Shares of Kellogg, Wolverine World Wide and Tennant all fell sharply Monday, as a massive sell-off on most of the major European exchanges triggered a big pullback on Wall Street.

And in the coming weeks, as more companies release their latest results, there will probably be many other examples of Europe's woes hurting profits.

"It's almost impossible for Europe to not be a problem for earnings going forward," said Bill Stone, chief investment strategist with PNC Asset Management Group in Philadelphia.

Even some U.S. multinationals that are doing well are being hurt a bit by the weakness in the euro zone. Eaton (ETN, Fortune 500), a Cleveland-based maker of electrical components and power systems for trucks and automobiles, reported earnings that topped forecasts Monday thanks to strength in its home market.

However, Eaton CEO Sandy Cutler noted that sales of electrical components in Europe dipped in the first quarter and that a turnaround is not likely until the second half of the year. "The recession in Europe is going to be longer than anticipated," Cutler said in an interview Monday.

Investors can still cling to the hope that Europe's recession does not trigger a major worldwide global slump. But concerns are growing following another soft report about the manufacturing sector in China Monday.

"China is more reliant on export activity to Europe than the U.S. And if there are bigger consequences for China from a Europe slowdown, that would have an impact on a whole host of other countries," said Mark Luschini, chief investment strategist with Janney Montgomery Scott in Pittsburgh.

Europe simply cannot be ignored. There are several reasons why it's tough to imagine significant improvement there anytime soon. Many European nations are trying to cut debt with austere budget measures. While that could help in the long-run, it will just make short-term problems worse.

It's even more troubling that investor sentiment regarding Europe has backslid so quickly. It was only a few months ago that the market was celebrating how the two rounds of long-term refinancing operations (or LTROs), cheap loans by the European Central Bank to European financial firms, supposedly meant the worst was over for Europe. So much for that.

"The LTROs may have helped relieve the risk of some sort of financial calamity. But it doesn't cure the problem that austerity crimps growth," said Luschini.

The fact that Europe has gone from being nothing to worry about to the potential epicenter of a global slowdown in such short order shows how fragile conditions are. Without more support from the ECB -- and perhaps the IMF -- it is unlikely that Europe will be able to move out of crisis mode anytime in the next few months.

Jason Pride, director of investment strategy with Glenmede in Philadelphia, said it appears that the ECB is going to be in a wait and see mode for a while. He thinks central bankers in Europe may be forced to consider more forms of easing if conditions deteriorate further. But until that happens, the next few months could be volatile for the markets.

"If economic growth is weaker in European nations implementing austerity, that is a drag for everybody. This is a global economy. Nobody is isolated," Pride said.

Best of StockTwits: Wal-Mart's shares took a nasty tumble on Monday following the reports over the weekend of an alleged bribery scandal in Mexico. But several traders shrugged off the news.

stockmonkeymom: $WMT-why is this a story? Bribery is everywhere, we just call it lobbying in the US.

BigKarma: $WMT Since when are bribes in Mexico or other countries news? I'd be more surprised if there weren't bribes.

ChiTownBA: Surprised to see $WMT off 5% on this Mexico scandal, will it really hurt the company that much?

JeffReevesIP: Can we stop leading with Walmart news on Marketwatch, CNBC etc? Corruption in Mexico is not news and won't materially affects $WMT earnings.

Is the 5% drop in Wal-Mart (WMT, Fortune 500) an overreaction? Perhaps. But as I say in today's Buzz video, I don't think people can be that glib. The baseball and steroids argument -- i.e. "Everybody is probably doing it, so why is this a problem?" -- is missing the bigger picture.

Wal-Mart now has to spend time and resources to deal with this scandal. Retail is a highly competitive business. Any distraction may not necessarily hurt earnings immediately. But it could give competitors who aren't dealing with similar issues, like Costco (COST, Fortune 500) and Target (TGT, Fortune 500) for example, an advantage.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: