How Main Street banks get what they want

Wall Street lobbyists have been heavy hitters on Capitol Hill for years. But the financial collapse left the sector with a black eye. Meanwhile, small banks are winning big.

|

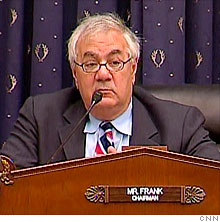

| Rep. Barney Frank's House Financial committee passed a bill that gave small banks a break. |

WASHINGTON (CNNMoney.com) -- In the wake of the financial meltdown, Wall Street banks remain pariahs in Washington. But Main Street banks are winning big.

The most recent win came this week, when a proposal to establish a new consumer watchdog agency passed a key House vote. Because of some savvy lobbying, the final version of the bill exempts thousands of small banks and credit unions from heightened examination and enforcement.

Earlier this year, credit unions helped ring the death knell for a Senate proposal that would have opened the door for judges to lower mortgage balances for bankrupt homeowners. Separately, small banks convinced the FDIC to reduce their insurance fund fees, saving them millions.

Experts say that banks of all kinds let their guard down in making loans during the boom. But the storyline these days on Capitol Hill is that Main Street banks were the good guys who didn't engage in the kinds of practices that nearly brought down the entire system.

And the smaller players are not only winning their own battles. When the interests of big and small banks align, the Main Street banks are often used as the frontpiece of lobbying campaigns to smooth the way for what the entire sector wants.

"The Wall Street banks that brought down our nation's economy through risky practices, they're radioactive," said Ed Mierzwinski, the consumer program director for U.S. Public Interest Research Group. "When Congress has a choice, Congress will help the little guys. They have a lot of influence."

One underlying reason for the lobbying prowess of some 8,000 Main Street banks is their sheer numbers and roots in local communities.

Bankers are often the business leaders in town, so they tend to be close to their members of Congress, said Steve Verdier, a top lobbyist for the Independent Community Bankers of America.

"The people who run those banks tend to be pretty important in the same way that auto dealers are, so they end up totally out-punching their weight in Congress," said Raj Daté, who runs nonprofit financial regulation research firm Cambridge Winter.

Indeed, small banks and credit unions aren't the biggest spenders in the political money game.

Three groups representing credit unions and small community banks spent about $880,000 in campaign contributions through the end of September and $5.7 million on lobbying in the first half of 2009, according to data analyzed by the Center for Responsive Politics.

By comparison, the financial sector as a whole spent $59 million in campaign contributions and $224 million on lobbying over the same period.

Main Street banks instead flexes muscle in face time on Capitol Hill.

For example, the three associations for small banks and credit unions have sent hundreds of financial executives to knock on lawmakers' doors since September. In the past week, the Credit Union National Association just dispatched execs from Massachusetts, Rhode Island and New Hampshire, spokesman Patrick Keefe said.

"Credit unions did not cause this crisis -- period," said Dan Berger, chief lobbyist for National Association of Federal Credit Unions, which brought 300 executives to Washington in September for a congressional caucus. "So, a good story to tell, combined with strong grass roots, makes for a very compelling political and policy position in Washington."

Sometimes the entire financial sector benefits from the power of Main Street banks. Veteran financial lobbyists say that Wall Street can get what it wants by hiding behind Main Street.

A case in point was last spring's fight over so-called mortgage cramdown.

Last April, credit union groups were tapped to negotiate a compromise on a bill that would have allowed judges to lower mortgage balances for homeowners in bankruptcy. The credit unions wouldn't budge.

Even though a few big Wall Street banks, like Citigroup (C, Fortune 500), had agreed to negotiate on the issue, most big banks had no interest in seeing such legislation pass. The proposal hasn't moved forward in the Senate, and the entire industry benefited from the credit unions' stance.

Sometimes, the two sides are at odds, as happened this spring when Main Street won at the expense of Wall Street.

After some 1,400 small bankers sent letters and e-mails to the Federal Deposit Insurance Corp., regulators changed the way assessments to the deposit insurance fund are calculated to benefit smaller banks. The change would only be a one time special assessment for the fund that protects investors when banks fail. But small banks saved millions. Big banks paid more.

The Consumer Financial Protection Agency was proposed to establish a new regulator solely dedicated to watching out for consumer interests on mortgages, credit cards and other consumer products.

But after lobbying by small banks, the House Financial Services Committee carved out all 8,000 Main Street banks, or 98% of all banks and credit unions, saying they could keep their regulator for examination and enforcement.

The move left only the largest institutions -- about 110 banks and 80 credit unions -- to face the new oversight. Lawmakers defended the move, pointing out the companies that would receive an extra layer of scrutiny control around 80% of bank assets nationwide.

Rep. Barney Frank, D-Mass., chairman of the House Financial Services Committee, explained the change by pointing out that community banks and credit unions don't make subprime mortgages and charge skyrocketing credit card fees. He later acknowledged that the House had "restricted the role" of the agency but he felt the compromise was "necessary to get the bill out."

Not one Democrat spoke against the change at the time, but several Republicans said it smacked of hypocrisy.

"If everyone cheated, and there's all this sin that's going on out there ... how then can you go back and say for 98% of the cases, don't worry," said Rep. Scott Garrett, R-N.J.

The consumer agency proposal must still be approved by the full House and Senate. Despite the legislative win, the credit union and the small bank associations continue to oppose the consumer agency in its current form. ![]()