Search News

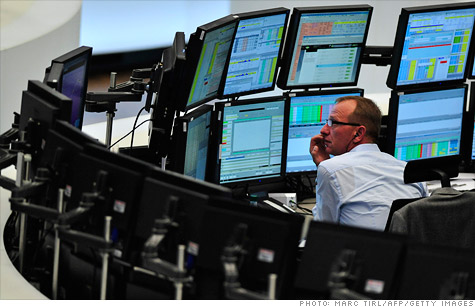

European stocks have had a nice run but the road ahead is fraught with risk. Click photo for latest world market data.

NEW YORK (CNNMoney) -- European stocks have rallied this year on hopes that a full-blown contagion can be avoided, but the outlook remains fraught with risks, not the least of which is what might happen with Greece.

The Euronext 100 (N100), which tracks European blue chip stocks, is up 6.5% so far this year. Germany's (DAX) benchmark index has jumped nearly 15%, while the U.K. market (UKX) has gained 6% and France's CAC40 (CAC40) has risen about 7%.

Despite those gains, European stocks have yet to fully recover from last year's punishing losses, suggesting there may still be more upside.

Stocks plunged across Europe last August on fears the banking system could collapse as the debt crisis appeared to be spreading from Greece to larger economies such as Italy and Spain.

Those contagion concerns have eased somewhat, largely due to aggressive moves by the European Central Bank.

The ECB has flooded the European banking system with cheap, long-term loans and relaxed its collateral standards in an effort to prevent a credit crunch. Investors have also welcomed steps eurozone governments have taken to form a so-called fiscal compact, designed to prevent a future crisis by strengthening budget discipline.

In addition, newly appointed governments in Rome and Madrid have made progress on key economic and fiscal reforms. As a result, borrowing costs for both governments have eased as investors have become more willing to buy Italian and Spanish bonds.

"We have seen signs that Europe is making painstakingly slow progress on the political and institutional front, and every step forward has resulted in positive market performance across Europe," said John Velis, head of capital markets for Russell Europe.

"[But] this progress will encounter setbacks from time to time," he cautioned.

For one, Greece needs to secure additional bailout money to avoid a default next month, and negotiations have not been going well.

After weeks of delays, eurozone finance ministers are expected to make a decision Monday on a second bailout worth €130 billion from the European Union, International Monetary Fund and European Central Bank.

Greece is also widely expected to announce a deal with its creditors in the private sector to write down a large portion of its debts.

A Greek government official told CNN Sunday that Greece expected to launch a debt swap on March 8 that would be completed by March 11. A spokesman for the Institute for International Finance, which represents the interests of bondholders, said he could not confirm any such deal was in place.

Resolving those issues could help European stocks, but Greece will probably need additional support and may not be able to avoid a default, said Eric Lascelles, chief economist at RBC Global Asset Management.

"Its debt load will likely remain too high, its economy remains uncompetitive, and the public and political will to enact the necessary reforms is precarious," Lascelles said.

Lascelles acknowledged that the ECB has helped mitigate the risk of a major banking crisis through its long-term loan program. And stocks could move even higher when the ECB offers a second round of loans later this month.

But the effectiveness of such programs "seems to wane with time," he warned. "The bottom line is that the ECB program has been enormously successful, but as much due to psychology as due to the reality of the program."

Meanwhile, there is also concern that plans to strengthen fiscal discipline will be watered down following elections in several eurozone nations later this year.

In particular, investors will closely monitor upcoming presidential elections in France, where incumbent Nicolas Sarkozy is facing a tough race against socialist frontrunner François Hollande.

"This could bring about a new government wanting to renegotiate the fiscal compact," said Andrew Milligan, head of global strategy at Standard Life Investments in Edinburgh. "Other elections could turn into referenda on whether the new rules are acceptable to different populations."

Milligan points out that many European companies are well positioned to compete in the global market, but it will still be precarious.

"Against the backdrop of weak to negative domestic economic activity, varying from country to country, an overall decline in profits looks likely," he said. "This remains a stock picking environment across the European equity universe."

-- CNN's Elinda Labropoulou contributed reporting from Athens and CNNMoney's Catherine Tymkiw contributed from New York ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: