Fortune 40: Best stocks to retire on

Our trademark long-term portfolio can help put you on the road to a secure future.

Market cap (billions): $83.6

P/E ratio*: 19

Earnings growth**: 11%

Dividend yield: 2.6%

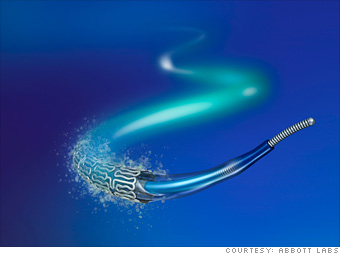

Abbott Laboratories, the fourth-largest drugmaker in terms of annual sales, has had tremendous success with fast-growing drugs like Humira, an anti-inflammatory, and Kaletra, an HIV treatment. Earnings in its last quarter surged 35%.

Despite the success of its pharmaceutical division, CEO Miles White is determined to keep focusing on the company's medical devices branch, which has emerged as a leader in drug-coated stents. White thinks this approach will help Abbott weather the regulatory and patent-related stumbling blocks that are hitting its pure pharma rivals.

NEXT: GROWTH AND INCOME: Coca-Cola

-

Abbott Labs -

Coca-Cola -

Colgate-P... -

General M... -

Illinois ... -

Johnson &... -

Procter &... -

US Bancorp -

Accenture -

Chubb -

Cisco Sys... -

McKesson -

3M -

Microsoft -

Parker Ha... -

Walgreen -

Applied I... -

Carlisle ... -

Cascade -

National ... -

Pfizer -

Regal Bel... -

UST -

VF Corp. -

Adtran -

AVX -

Fair Isaac -

Global In... -

Grey Wolf -

Penn Virg... -

Plexus -

Tessera T... -

BP -

Diageo -

Novartis -

Philips E... -

Sanofi-Av... -

Total -

Unilever -

Vodafone ...

Last updated June 20 2008: 2:35 PM ET

Criteria include long-term earnings growth equal to or greater than the S&P 500's estimated 7% rate, dividend yield greater than the S&P 500's 2%, and P/E ratios below 27.

*Based on previous 12-months' reported earnings.

**Wall Street estimates for the next three to five years.

Source: Zacks Investment Research

*Based on previous 12-months' reported earnings.

**Wall Street estimates for the next three to five years.

Source: Zacks Investment Research